Market Wrap: Genesis Withdrawal Suspension Looms Over Cryptocurrencies

Top Story

Et tu, Genesis Global Capital? The lending arm of crypto investment bank Genesis Global Trading temporarily suspended redemptions and new loan originations, adding to the rapidly widening fallout from crypto exchange FTX’s collapse.

This article originally appeared in Market Wrap, CoinDesk’s daily newsletter diving into what happened in today's crypto markets. Subscribe to get it in your inbox every day.

- Interim CEO Derar Islim told customers on a call that Genesis is exploring solutions for the lending unit, including finding a source of fresh liquidity. He said Genesis intends to detail its plan to clients next week.

- Genesis Global Capital serves an institutional client base and had $2.8 billion in total active loans as of the end of the third quarter of 2022, according to the company’s website. Genesis owner Digital Currency Group (DCG) is also the parent company of CoinDesk.

- Islim added that Genesis’ trading and custody services via Genesis Trading, which acts as Genesis Global Capital’s broker/dealer, remain fully operational. Genesis Trading is independently capitalized and operated from the lending arm, Islim said.

- "Today Genesis Global Capital, Genesis's lending business, made the difficult decision to temporarily suspend redemptions and new loan originations. This decision was made in response to the extreme market dislocation and loss of industry confidence caused by the FTX implosion," said Amanda Cowie, vice president of communications and marketing at DCG.

- Genesis’ announcement is the latest entanglement to FTX’s liquidity crisis and subsequent filing for Chapter 11 bankruptcy protection last week. The industry is already reeling from multiple debacles earlier this year, including the collapse of the terraUSD (UST) stablecoin and the LUNA token that backs it.

- But Dr. Anna Becker, CEO and co-founder of alternative investment firm EndoTech, sees the FTX crisis as a potential building block for the industry. “The improper custody of funds and reckless risk management continue to have a devastating impact on innocent consumers. It is totally unacceptable…We urge those who continue to build this industry, as well as the SEC, FDIC and other regulatory bodies to work together in order to ensure the well-being of investors and uproot bad actors from our industry.

Other News

Bitcoin fell about 1.5% over the past 24 hours to trade at about $1,600 as investors considered the latest debacle to afflict the crypto industry. Ether was recently changing hands at about $1,200, off more than 3%. Other major cryptocurrencies were largely in the red with FTX’s FTT token declining more than 14% and Serum’s SRM dropping more than 6%. FTX founder Sam Bankman-Fried had been a major supporter of Serum, a decentralized exchange protocol on the Solana blockchain.

Digital asset manager Grayscale Investments sought to reassure investors they will not be affected by Genesis Global Capital suspending withdrawals in the wake of FTX's collapse. Grayscale is a unit of Digital Currency Group, the parent company of Genesis Global Capital and Grayscale. Grayscale announced via Twitter on Wednesday that "Genesis Global Capital is not a counterparty or service provider for any Grayscale product."

Crypto investors in the U.S. filed a class-action suit accusing Sam Bankman-Fried and the company’s host of paid celebrity promoters, including NFL quarterback Tom Brady, comedian Larry David, tennis player Naomi Osaka and NBA team the Golden State Warriors, with fraudulently promoting FTX yield-bearing account (YBAs). The plaintiffs called the FTX platform “a house of cards” and “Ponzi scheme... where the FTX Entities shuffled customer funds between their opaque affiliated entities, using new investor funds obtained through investments in the YBAs and loans to pay interest to the old ones and to attempt to maintain the appearance of liquidity.”

Latest Prices

Market Analysis

Crypto Market Bottom?

By Glenn Williams Jr.

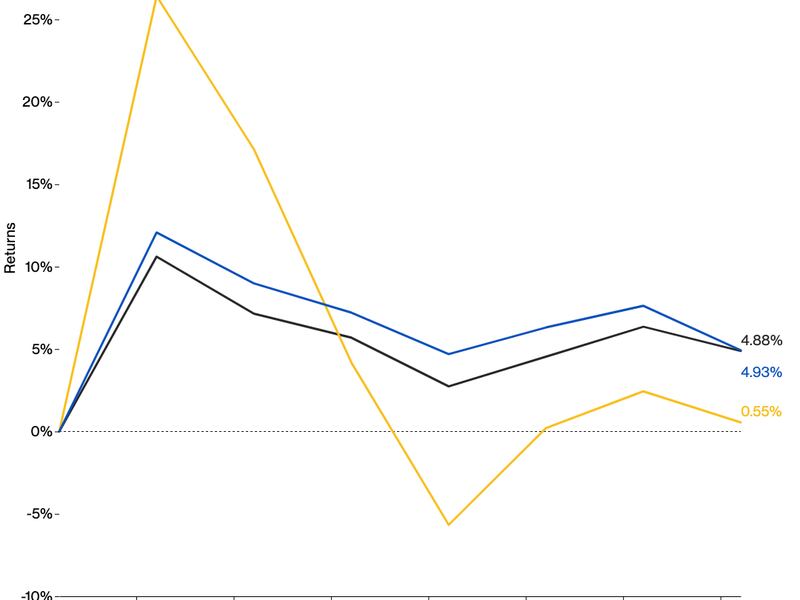

For both BTC and ETH, the magnitude of price movement since January 2022 has been declining, when using the Average True Range of daily price movement as a proxy.

A lack of price movement gives investors less opportunity to generate gains. Now, as investors focus more on avoiding calamity than producing alpha, a new trading range appears to be forming around the $16,500 level for BTC.

Where previously the market saw significant price agreement between the $19,000 to $20,000 range, the recent turmoil has pushed it to a lower level.

Read the full technical take here.

Altcoin Roundup

- Crypto Market Slides After Genesis Withdrawal Halt, but Big Investors May Hunt for Bargains: Most digital assets traded lower on Wednesday as another crypto firm gets hit by the FTX contagion, although institutional investors may be looking for bargains. As of press time, Solana’s SOL token slid 1% to $14. Aptos was one of the few winners Wednesday. The APT token was trading around $4, up 10% in the past 24 hours. Read more here.

Trending posts

- Listen 🎧: Today’s "CoinDesk Markets Daily" podcast discusses the latest market movements and a look at reflections on Effective Altruism.

- Market Maker B2C2 Offers to Buy Loans From Genesis Crypto-Lending Unit

- Grayscale Declares 'Business as Usual' Despite Sister Company Genesis Global Capital Suspending Withdrawals

- These Crypto Market Makers Were Wary of FTX Before Collapse

- DeFi Giant MakerDAO Speeds Up DAI Transactions and Withdrawals, Expands to Arbitrum, Osmosis:

- U.S. Crypto Investors Sue FTX’s Sam Bankman-Fried, Company’s Celebrity Endorsers

- Top House Committee to Hold Hearing Into FTX Collapse

- Matter Labs Nets $200M to Build zkSync Ethereum Scaling Platform