Market Wrap: Cryptos Recover Slightly From FTX Fatigue With a Dose of Encouraging Inflation Data

Price Action

On Day Four of crypto exchange FTX’s near-death experience, crypto markets sighed and did what they often have done historically: rally.

On Thursday they had cause for optimism when an unexpectedly positive Consumer Price Index report indicated the U.S. Federal Reserve’s recent diet of hawkish, 75 basis point interest rate hikes were working towards reducing a year-long bout of high inflation.

This article originally appeared in Market Wrap, CoinDesk’s daily newsletter diving into what happened in today's crypto markets. Subscribe to get it in your inbox every day.

Bitcoin was recently trading near $18,000, a more than 13% increase over the past 24 hours that made its Wednesday plunge below $16,000 – to a level not seen since late 2020 – seem antiquated.

Ether was recently changing hands over $1,300, up almost 17% from Wednesday, same time. All other cryptos in the top 20 by market capitalization were feeling more like themselves again, rising well into the double digits as FTX and inflation fatigue waned – at least temporarily. Even FTX’s beleaguered FTT token, whose accumulation by the exchange’s sister company Alameda Research ignited the current mess, was up over 50% to $3.40. Solana’s SOL, which also figured prominently on Alameda’s balance sheet, raising investor alarm, jumped more than 40%.

The CoinDesk Market Index, a broad-based index designed to measure the market capitalization weighted performance of the digital asset market, rose 12%.

Stocks soared, staging their biggest rally in two years as investors celebrated the heartening CPI inflation data. The tech-heavy Nasdaq rose 7.3%, while the S&P 500 and Dow Jones Industrial Average (DJIA) increased 5.5% and 3.7%, respectively.

In an email to CoinDesk, 3iQ Head of Research Mark Connors noted optimistically that the “one persistent development” distinguishing “the crypto winter from all others is the emergence of ETH dominance as measured by the ETH/BTC ratio.”

Latest Prices

Technical Take

Crypto's Sharp Declines in Price, Trading Volatility Could Be Worse

By Glenn Williams Jr.

Crypto prices have been volatile, although markets have seen worse in their brief history.

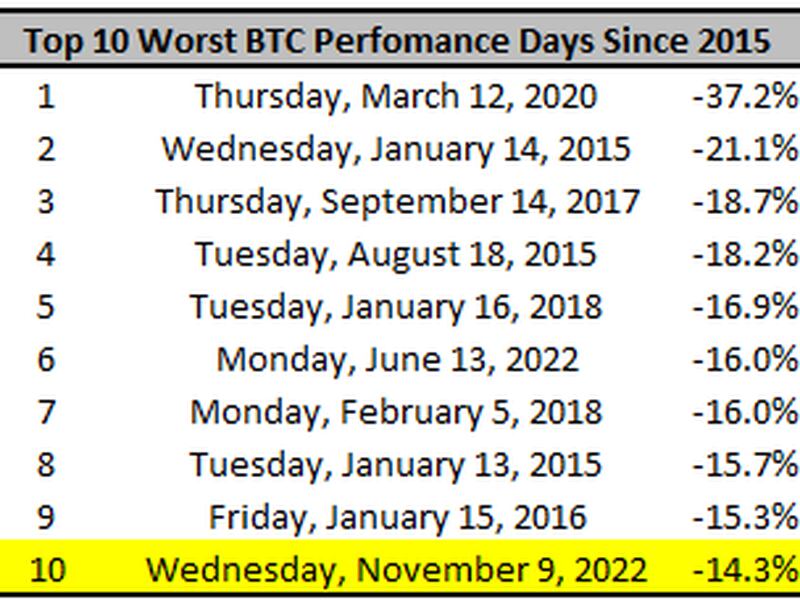

BTC’s Nov. 9 decline was its 10th-largest decrease since 2015, although it's only the second-largest decline for 2022, highlighting how tumultuous the year has been.

Read the full technical take here.

Altcoin Roundup

- Tron's TRX Jumps 140% Amid 1:1 FTX Redemption of Tron-Based Tokens: TRX, the native token of the Tron network, surged over 140% on cryptocurrency exchange FTX, from 12 cents to 29 cents after Tron founder Justin Sun agreed to move Tron-based assets from FTX to external wallets. Read more here.

- Solana’s SOL Surges After Blockchain's Foundation Delays Plan to Unstake Tokens: A record amount of SOL was unstaked as investors reclaimed their tokens from the blockchain's security mechanism. But it could have been a lot more. As of press time, the SOL price jumped 46% in the past 24 hours. Read more here.

Trending posts

- Listen 🎧: Today’s "CoinDesk Markets Daily" podcast discusses the latest market movements and a look at Bloomberg’s epic story on crypto.

- Tether Freezes $46M of USDT Held by FTX Following Law-Enforcement Request: The stablecoin lost its $1 peg earlier on Thursday.

- FTX Balances Tumbled 87% in 5 Days in Epic Crypto Deposit Run, Data Shows: A glance at data from Arkham Intelligence shows the behind-the-scenes operational reality that drove billionaire Sam Bankman-Fried's beleaguered FTX exchange to order a withdrawal halt this week.

- US Justice Department, Regulators Contacted Binance on FTX Talks, Source: The authorities want to know what Binance learned about FTX's inner workings.

- Several Investors in Talks for $9.4B FTX Rescue, Reuters Reports: A group of investors are involved in bailout talks for Sam Bankman-Fried's troubled crypto exchange, Reuters reported.

- Revisiting MicroStrategy's Pain Points as Bitcoin Tumbles: This week's plunge in the price of bitcoin again raises questions as to whether Executive Director Michael Saylor will at some point be forced to sell some or all of his company's vast holdings.

- JPMorgan Sees Wave of Crypto Deleveraging From FTX’s Woes: JPMorgan strategists said bitcoin's production cost could be an indicator of the market bottom.

- Cathie Woods’ ARK Buys 238K More Shares in Coinbase Exchange Amid Crypto Rout: The purchase adds to the more than 400,000 Coinbase shares bought by ARK’s exchange-traded funds earlier this week.