Market Wrap: Crypto Markets Flatten as Latest Employment Data Throws a Setback for Inflation Hawks

Price Action

Bitcoin and ether prices flattened in Wednesday trading as investors weighed the latest jobs data suggesting the economy isn’t finished growing.

Bitcoin’s (BTC) price slumped a fraction of a percentage point on Wednesday but climbed back above the $20,000 level after slumping below earlier in the day. BTC had declined overnight and accelerated for several hours, with the sharpest decline occurring during the 13:00 UTC hour (9:00 a.m. ET), as U.S. traditional markets opened and ADP’s Employment report on job creation in the private sector arrived hotter than expected. BTC volume during the downturn exceeded its average volume during that time frame by 5 times.

Ether’s (ETH) price’s also declined, as the second-largest cryptocurrency by market capitalization fell 0.95%, erasing a portion of its gains from the prior two days. ETH’s biggest drop occurred during the 13:00 UTC (9:00 a.m. ET) timeframe. ETH prices are down 19% since the Merge, the Ethereum network’s conversion from a proof-of-work consensus mechanism to a proof-of-stake system on Sept. 15.

The CoinDesk Market Index (CMI), a broad-based market index that measures the performance of a basket of cryptocurrencies, recently declined by 0.32%.

Economic Calendar: ADP Employment, which measures job creation among private U.S. businesses, grew by 208,000 in September, versus consensus estimates of 200,000, and a 12% increase over the 185,000 jobs created in August. According to the report, annual pay increased 7.8% for workers who stayed at their jobs, while wages for job changers increased 15.7%. The news, which showed a still-hot jobs market, indicated that the economy is not slowing as much as inflation hawks had hoped to see.

OPEC (the Organization of Petroleum Exporting Countries) announced a 2 million barrel per day cut in oil production.

In the U.S., crude oil inventories dropped by 1.36 million barrels versus expectations for a 2.1 million barrel increase for the week ending Sept 30. Gasoline inventories fell by 4.7 million barrels, significantly more than the expected 1.3 million barrel decrease, and the largest decline in eight weeks.

Both developments will likely send energy prices higher, a challenging scenario given the U.S. central bank’s current priority to tame inflation.

U.S. Equities: Traditional stocks declined following strong labor data, as the Dow Jones Industrial Average (DJIA), tech-heavy Nasdaq composite and S&P 500 fell 0.14%, 0.25% and 0.20%, respectively.

Commodities: Energy markets rose following the OPEC announcement and U.S. inventory data, as WTI and Brent European crude increased 1.8% and 2%, respectively. Natural gas prices increased 1.8%.

In metals, gold prices declined 0.3%, while copper futures rose 1.6%

Latest Prices

● Bitcoin (BTC): $20,041 −1.6%

● Ether (ETH): $1,348 −1.2%

● CoinDesk Market Index (CMI): 980.86 −0.7%

● S&P 500 daily close: 3,783.28 −0.2%

● Gold: $1,725 per troy ounce +0.2%

● Ten-year Treasury yield daily close: 3.76% +0.1

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Technical Take

BTC continues to trade in a consolidated range

BTC prices spent much of Wednesday toggling above and below $20,000, as the largest cryptocurrency by market cap continues to trade in a tight range.

The Average True Range (ATR) for BTC has decreased 64% in 2022. ATR measures an asset’s daily range of movement. The contraction of ATR for bitcoin signals prices have gotten less volatile.

In lieu of a tangible catalyst, BTC continues to fluctuate as the narrative around economic growth changes. Tuesday’s Market Wrap highlighted increased optimism for a Federal Reserve pivot to lower interest rates, which seemingly pushed risk assets (both traditional and digital) higher.

Today’s better-than-expected ADP jobs data is having the opposite effect, giving the Fed additional cover to follow through on its intentions to push interest rates aggressively higher. The CME FedWatch tool continues to project another hefty 0.75-percentage-point (75-basis-point) rate hike in November.

For BTC investors looking for bullish signs, on-chain analytics offer potential clues for bitcoin price expansion when volatility begins to increase.

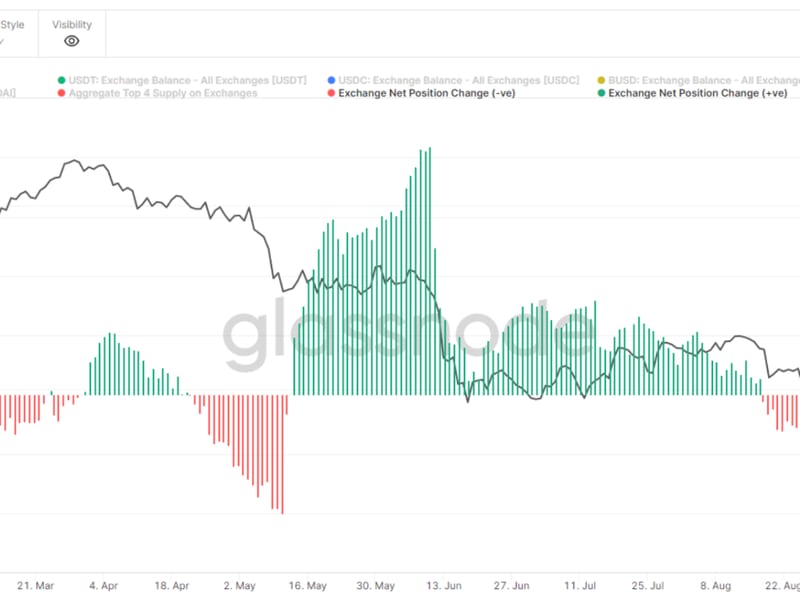

The net position change for stablecoins (denoted in green in the chart below) on cryptocurrency exchanges has begun to increase again, and has been net positive in each of the most recent 24 days.

Often an increase in the balance of stablecoins implies additional buying pressure for an asset, whereas the increased supply of cryptocurrencies (i.e. BTC and ETH), implies increased selling pressure.

For BTC investors leaning bearishly, the current bitcoin price appears to be near its production cost.

Glassnode’s Difficulty Regression Model estimates the “cost of production” for BTC miners, and currently it puts that at approximately $18,081, or 11% below bitcoin’s current price. A reduction in BTC’s price below this figure is likely to add stress to bitcoin miners, which could have a downward impact on prices as well.

Viewing that in conjunction with technical data, however, implies that while nearing the cost of production, buying support exists at levels above $18,000.

Volume Profile Visual Range (VPVR), a tool that illustrates trading volume by price level, indicates that historically BTC investors have been willing to add to long positions in a range between $19,000 and $20,000.

Altcoin Roundup

- Decentralized Exchange Token GMX Surges After Binance, FTX Listings: The token of the decentralized exchange GMX gained popularity for defying this year’s crypto rout, and it nearly hit its previous all-time high after Binance and FTX, two of the world’s most widely used crypto exchanges, announced plans to list the token. Read more here.

- Mythical Games Creates Mythos Foundation to Decentralize Web3 Gaming: The gaming technology company is also expanding its ecosystem with the Mythos DAO and the MYTH governance token, an ERC-20 token with a total supply of one billion. Read more here.

Trending posts

- Listen 🎧: Today’s "CoinDesk Markets Daily" podcast discusses the latest market movements and a look at a case in which the Securities and Exchange Commission (SEC) appears to regulate by enforcement.

- Interest Surges in Bitcoin Speculation, But It Might Be Bearish: Open interest in bitcoin perpetual swaps – a type of leveraged trading contract in cryptocurrency markets – has spiked to an all-time high.

- Do Kwon Denies Report That South Korean Prosecutors Froze $39.6M of His Crypto: “I don't know whose funds they've frozen, but good for them, hope they use it for good,” he tweeted.

- Investment Manager Hamilton Lane to Tokenize 3 Funds Through Securitize: The move will make private market investments available to more people.

- Second Crypto Group Objects to CFTC's Use of Chat Bot to Serve Legal Papers: Washington, D.C.-based lobbying group The DeFi Education Fund wants the Commodity Futures Trading Commission (CFTC) to identify and serve Ooki DAO's actual members, rather than just serve the DAO at large.

- What’s Going On With Ethereum’s MEV-Boost?: Flashbots' block relayers continue to dominate the Ethereum validator ecosystem. And with them, censorship continues to grow.

- Middle East/North Africa Was Fastest-Growing Crypto Market Over Past 12 Months, Chainalysis Reports: MENA-based users received $566 billion in cryptocurrency from July 2021 to June 2022.

- Italy Hasn't Vetted the 73 Crypto Firms It Approved This Year: Companies entered into a new registry for crypto firms say they’ve secured regulatory approval in Italy, but they haven’t been checked for compliance yet.

CoinDesk Market Index

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Numeraire | NMR | +16.49% | DeFi |

| Injective | INJ | +7.4% | DeFi |

| Ethereum Name Service | ENS | +6.54% | Digitization |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| SHIBA INU | SHIB | -9.09% | Currency |

| Render Token | RNDR | -4.93% | Computing |

| Polymath | POLY | -4.53% | DeFi |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.