World's Most Influential Central Banks' Balance Sheets Look to Have Troughed

The world's leading central banks appear to have stopped shrinking their balance sheets, a tactic they adopted last year to control inflation in a program that destabilized risk assets, including cryptocurrencies.

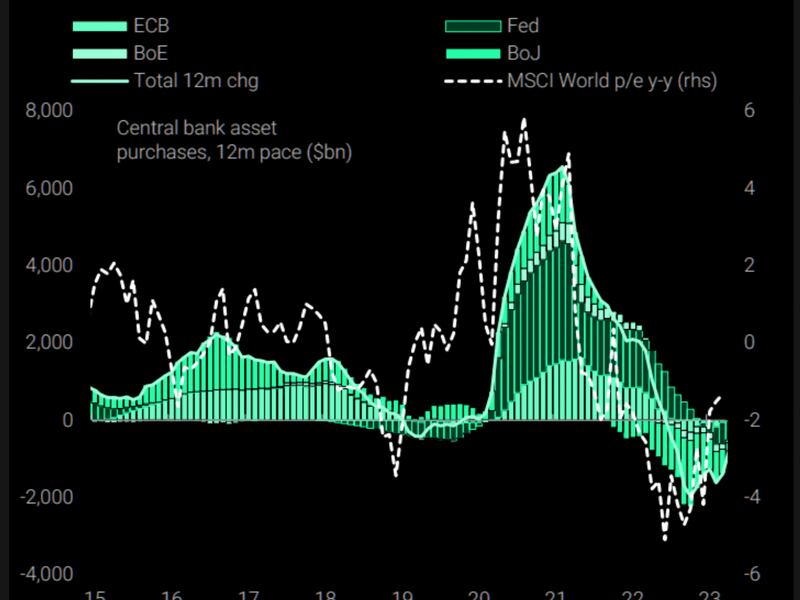

The so-called quantitative tightening ended recently and the cumulative balance sheet of major central banks – the U.S. Federal Reserve (Fed), European Central Bank (ECB), Bank of England (BOE) and Bank of Japan (BOJ) – has troughed, according to data tracked by macroeconomic research firm TS Lombard and sourced from The Market Ear newsletter.

"The 'delta of the delta' has reversed lately. Possible tailwind for markets," Thursday's edition of The Market Ear said, referring to the dip in the size of the banks' balance sheets.

Expansion of central banks' balance sheets is widely considered bullish for risk assets, including bitcoin.

That's because entities involved in financial markets are often the first recipients of the money newly created through balance sheet expansion, according to a theory proposed by 18th-century Irish-French economist Richard Cantillon. These entities use the money received to drive asset prices higher.

The jury is still out on whether the Fed's recent extension of loans to local lenders will result in fresh money creation. Meanwhile the BOJ continues to print money through bond purchases, compensating for the ECB and BOE's shrinkage. The Chinese credit impulse has recently bottomed out in a sign of renewed credit expansion relative to the size of the economy.