First Mover Asia: The Next Avraham Eisenberg Isn’t Going to Be a ChatGPT Powered ‘Script Kiddie’

Good morning. Here’s what’s happening:

Prices: Bitcoin was higher for the 10th time in 12 days, pushing $18K for first time since mid-December, in a mostly green Wednesday.

Insights: The Next Avraham Eisenberg Isn’t Going to Be a ChatGPT ‘Script Kiddie’

Prices

Bitcoin pushes toward $18K

By Bradley Koeun

Just days after bitcoin (BTC) crossed the $17,000 price threshold for the first time in weeks, the largest cryptocurrency is now on the verge of taking $18,000.

The question now is whether the rally can last; bitcoin has gained in 10 of the past 12 days. CoinDesk markets analyst Glenn Williams Jr. took a look at blockchain data for clues on the outlook.

As of press time, BTC was changing hands around $17,900, up 2.8% over the past 24 hours. The CoinDesk Market Index (CMI) was up 3%.

The U.S. government's latest release of the the most widely tracked inflation figures, the Consumer Price Index, is due out Thursday, covering price increases in December. The question is whether the report will show a significant enough decline in inflation to warrant a slowdown in monetary tightening by the Federal Reserve.

"Holders of risk assets such as crypto are hoping for a soft CPI print to signal inflation easing," the analysis firm FundStrat wrote Wednesday in a note to clients.

According to Oanda Senior Market Analyst Edward Moya, many institutional investors remain cautious despite this week's rally.

"If risk appetite remains intact post-inflation-report, bitcoin could make another run at the $18,500 level," Moya predicted Wednesday. "If core prices prove to be troubling, bitcoin could decline back towards the December lows."

Insights

DeFi is Too Complex for ChatGPT

By Sam Reynolds

A few days ago, Ars Technica covered an interesting and novel use case of AI chatbot ChatGPT, which in its few months of existence, has been used for everything from plagiarism to making high-end business intelligence analytics more accessible.

The kids are now making hacking tools.

It’s a return of the script kiddies.

Back in the mid-1990s, well before the days of the dark web, corporate America feared hackers. The nation’s economy had rapidly become computerized, but despite the incredible increases in efficiency this brought, IT security was still fairly unsophisticated at the time.

From this era came a few fabled names, like Kevin Mitnick, who broke into the networks of commercial giants like Apple and Motorola while eluding the U.S. Federal Bureau of Investigation (FBI) for years, to the hacker groups Legion of Doom and Masters of Deception, which battled each other with grander and grander hacks in a game of one-upmanship (now-Decrypt CEO Josh Quittner documented this for WIRED in 1994 and later wrote a book on it).

But in the shadow of these groups were another class of hackers called “script kiddies.” Usually teenagers or young adults, they didn’t have the know-how to create exploits from scratch. Instead, they lurked on the hacker forums frequented by these notable names and used the exploits they developed to cause chaos.

As Ars Technica documents, thanks to ChatGPT's ability to create code, the possibility for low to moderately-skilled hackers to get an edge is enormous. Everything from producing bots for information stealing, to building entirely new darknet markets for illicit trading, is now possible for the layman.

But what does this mean for DeFi?

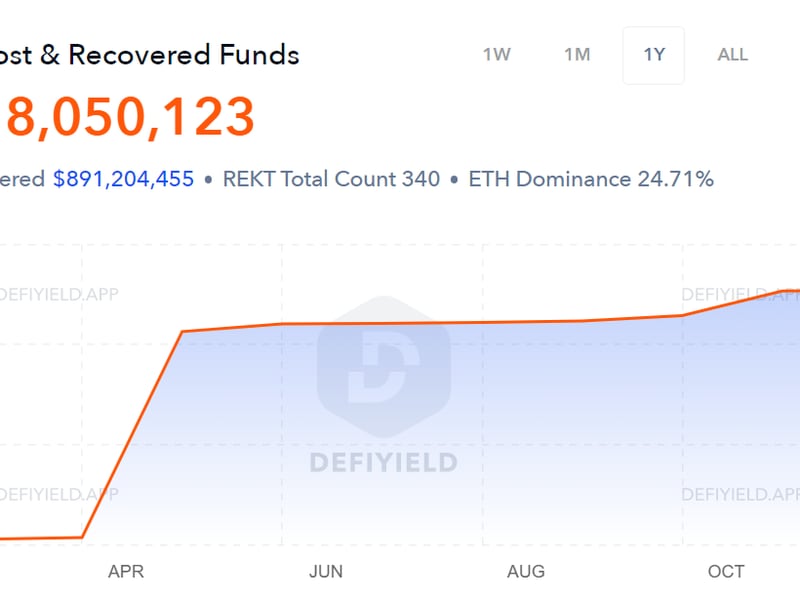

The future of finance sure is defined as having shoddy security. According to DeFi Yield’s REKT Database, over $50 billion was lost during the last year to DeFi exploits.

Now, these aren’t all hacks. Some of them were exploits. In the case of Mango Markets, for instance, Avraham Eisenberg didn’t break any code (a hack), but rather created clever scripts to exploit market conditions in his favor.

But the question is, now that the script kiddies have figured out how to make hacking tools with ChatGPT, will they do the same for DeFi?

After all, there’s at least $50 billion for the taking, based on the data.

Not so fast, says Yajin Zhou, CEO of Blockchain Security firm BlocSec. DeFi is such a unique beast, that while the ChatGPT might be able to put a “normal” exploit together, DeFi is just too complicated for it.

“It’s not time to panic yet. ChatGPT’s ability to generate a working DeFi exploit is still at an early stage of development. It cannot generate functional exploits for vulnerabilities that involve complicated DeFi semantics,” he told CoinDesk.

George Zhang, Head of Developer Relations at wallet provider UniPass, added that ChatGPT simply isn’t able to write code at the level of precision required yet.

“Smart contract hacks require very precise code to work. I wouldn’t worry about ChatGPT bringing DeFi security armageddon,” Zhang wrote to CoinDesk in an email. “It is possible for attackers to leverage ChatGPT to generate malicious code, but ChatGPT-generated code would mostly only work for very poorly written smart contracts.”

For the attack to be successful, the smart contract would have to contain very basic, 101-level mistakes, Zhang noted. Testing that his team has done shows the tech is still far from reaching the necessary level of automation to be a threat.

“A considerable amount of proprietary data relating to the smart contract and labeling of potential exploits are necessary for the attack to even have a shot,” he said.

It seems like DeFi exploiter is one job that won’t be immediately disrupted by the AI revolution.

Important events.

12:30 p.m. HKT/SGT(4:30 UTC) United States Consumer Price Index (YoY/Dec)

12:30 p.m. HKT/SGT(4:30 UTC) United States Initial Jobless Claims (Jan 6)

6:00 a.m. HKT/SGT(22:00 UTC) United Kingdom Gross Domestic Product (MoM/Nov)

CoinDesk TV

In case you missed it, here is the most recent episode of "First Mover" on CoinDesk TV:

ARK Makes Coinbase Buy; Bitcoin CME Futures Draw Premium for First Time Since FTX's Collapse

According to an investor update email, Cathie Wood has added 33,756 shares of Coinbase (COIN) to ARK’s Innovation ETF (ARKK), worth around $1.45 million based on the January 10 closing price. Oppenheimer Senior Analyst Owen Lau shared his outlook regarding the crypto exchange. Plus, Gemini's Cameron Winklevoss called for the ouster of Digital Currency Group (DCG) CEO Barry Silbert. DCG is the parent company of CoinDesk. Lumida CEO & Co-Founder Ram Ahluwalia weighed in on the rising tensions. And, Innovating Capital General Partner Anthony Georgiades shared his crypto markets analysis.

Headlines

Bitcoin SV Drops as Robinhood Ends Support: The online trading app tells users any BSV still in their Robinhood crypto account will be sold for market value after Jan. 25.

Binance Wins Seventh Approval in Europe, Registers With Swedish Regulator: The registration in Sweden follows those in France, Italy, Lithuania, Spain, Cyprus and Poland.

Ethereum Upgrade Could Make It Harder to Lose All Your Crypto: Account abstraction – a concept recently embraced by Visa – could make Ethereum wallets significantly more user friendly.

ARK Makes Coinbase Buy as COIN Jumps 20% on Week: Cathie Wood has added another 33,756 shares of Coinbase to ARK’s ARKK ETF, according to an investor update.

SingularityNET’s AGIX Leads AI-Focused Token Pump Narrative in New Year: The blockchain AI project’s utility token has surged 18% in the past 24 hours, with market speculation tied to the news of Microsoft's plans to invest in OpenAI.

China Includes Digital Yuan in Cash Circulation Data for First Time: The digital yuan, e-CNY, represented 0.13% of cash and reserves held by the central bank.