First Mover Asia: Bitcoin, Ether Bounce Back After Being Tested by Fed Chair Powell’s Comments

Good morning. Here’s what’s happening:

Prices: In prepared comments before the U.S. Senate's Banking Committee, Fed Chair Jerome Powell said that inflation remained problematic. Bitcoin tumbled initially but later recovered.

Insights: CrytoRank data shows that despite their down 2022, many crypto funds have risen over the past three years.

Prices

Bitcoin, Ether Being Tested by Powell’s Comments

Good morning Asia, here’s how the markets are performing today.

Bitcoin and Ether began the morning in Asia in the green, but are back in the red, if ever so slightly, after Federal Reserve Chairman Jerome Powell said that the economy is running hotter than expected and the Fed is “prepared to increase the pace of rate hikes” in the name of maintaining price stability.

The world’s largest digital asset is beginning the Asia trading day at $22,249, down 1.1% in the last hour while ether is trading at $1,568, down 0.4% in the last day.

“I think there will be an impact on anything that’s valued or traded against the U.S. dollar,” AdvisorShares CEO Noah Hamman said on a recent appearance of CoinDesk TV’s All About Bitcoin. “ The secondary concern is the reduction of the Fed’s balance sheet. This pulls a lot of liquidity out of the market and that’s more challenging for risky assets.”

Meanwhile, China token Conflux is up 9.1% during the last 24 hours. In the past week, the token is up 12.8%, outperforming other China narrative coins such as NEO and Filecoin.

Ether continues to outperform bitcoin, if ever so slightly. Bitcoin is down around 1% during the last 48 hours, while ether is down 0.25%.

“There’s significant narrative and meaningful structural tailwinds behind Ethereum over the next 12-18 months with the Shanghai [upgrade] and a lot of staking becoming liquid,” Quinn Thompson, the head of capital markets at Maple Finance, told CoinDesk TV during a recent interview.

While Ethereum, and the mission-critical pieces of infrastructure might be having their moment, Thompson said some of the more “speculative” projects on the “longer tail of the spectrum” are going to struggle.

“That’s kind of the problem plaguing crypto right now. With on-chain activity lower, new addresses lower, there’s not really an uptick in activity that coincides with an uptick in revenue,” he said. “Most protocols and projects in the space are facing a little bit of a crunch on the budget side.”

All this is helping the consolidation narrative, he said, leading to majors like bitcoin and Ether outperforming.

Insights

Crypto Funds Are Dented but Hardly Broken After 2022 Freefall.

Crypto fund Multicoin Capital recently disclosed to investors that its hedge fund lost 91% of its value. Sino Global, once on top of the crypto world, found itself dragged into the black hole of FTX-Alameda because of close ties to Sam Bankman-Fried and his universe of tokens.

In any other industry, like TradFi or tech, this would be the end of these funds. Losing almost the entirety of the fund would mean its moneymen, the limited partners (LPs), would ensure everyone involved in executing the fund’s investment strategy is fired.

But this is crypto, and things work differently.

While there is still some rot within the crypto VC industry, and Galois Capital, which shut its doors in late February after losing $40 million to the collapse of FTX, won’t be the last fund to fail, many of these funds are enduring. And a number of them are even over a longer time horizon.

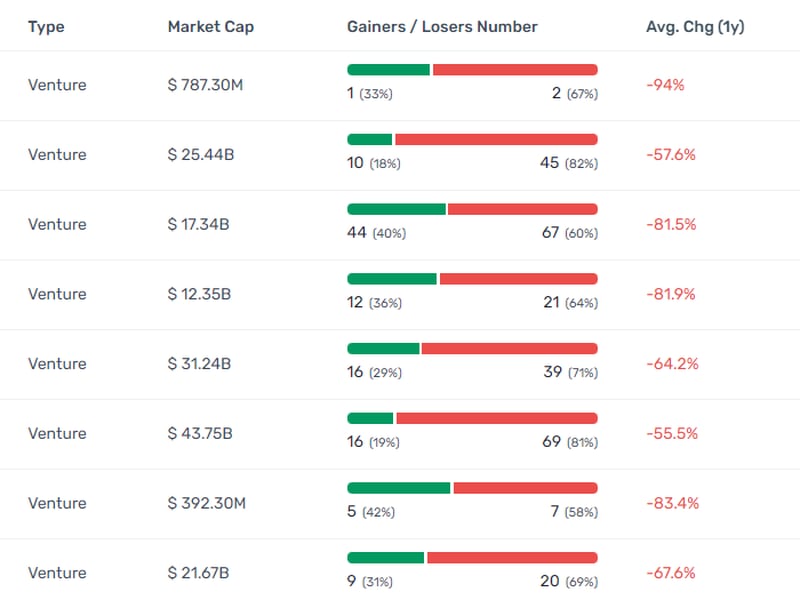

Data from CryptoRank, which tracks the fund's portfolios and known holdings shows that while major funds like Delphi Digital, Polychain or Animoca are down an eye-watering 80%, 64%, and 81%, over the course of the last 365 days, they are still well into the green during the last three years.

Many are also up over the last three months, thanks to the mini-bull market in January and early February.

Nature is healing. Bitcoin is trading above $20,283, its price on Nov. 2, the day FTX collapsed.. There are many tokens still in the red, but plenty that have posted incredible and somewhat unexpected gains in the last few weeks. Who saw the rise of the China tokens like Conflux or Filecoin?

But there are a few caveats.

CryptoRank can’t track the value of equity investments the firms would have made (though there are always more tokens than equity in their bag) nor can it track the preferential prices they might have secured for the tokens as an investor.

It also doesn’t know if funds have capital stuck on FTX – because courts won’t unseal a list of creditors. Token prices are liquid, and are bouncing back. But capital stuck on FTX will be an Achilles heel for funds, given that it might take a decade to recover.

Important events.

9:00 a.m. HKT/SGT(1:00 UTC) Eurozone Gross Domestic Product s.a. (YoY/Q4)

12:15 p.m. HKT/SGT(4:15 UTC) United States ADP Employment Change (Feb)

CoinDesk TV

In case you missed it, here is the most recent episode of "First Mover" on CoinDesk TV:

Grayscale Bitcoin Trust at Issue in Court; Yuga Labs Co-founder on Bitcoin NFT Collection

The Grayscale Bitcoin Trust discount to net asset value has fallen to its lowest level in a month, ahead of oral arguments in federal court related to Grayscale's lawsuit against the SEC. Grayscale and CoinDesk are both owned by DCG. Maple Finance Head of Capital Markets Quinn Thompson shared his crypto markets analysis. Plus, the company behind Bored Ape Yacht Club generated $16.5 million from its auction of 288 NFTs in its TwelveFold collection based on the Ordinals protocol. Yuga Labs co-founder Greg Solano shared his reaction. And, Uniswap Labs Chief Operating Officer Mary-Catherine Lader joined the conversation.

Headlines

GBTC Discount Narrows to Lowest Level Since November Following Court Hearing: The three-judge panel appeared skeptical of the SEC’s reasoning for denying conversion of the trust to an ETF.

Latin American Travel Agency Despegar Begins Accepting Crypto Payments: Teaming with Binance Pay, the travel company will initially accept crypto in Argentina, with plans to roll this option out to additional countries.

Esports Giant TSM Enters Into Web3 Gaming Partnership With Avalanche: Avalanche will be TSM's exclusive blockchain partner as it builds out its competitive gaming platform, Blitz.

Thailand Offers $1B Tax Break for Firms Issuing Investment Tokens, Reuters: The country will waive corporation and sales taxes for those firms.

Yuga Labs Co-Founder Says First Bitcoin NFT Auction Doesn’t Open Door to Scammers: Greg Solano said the company’s use of the Bitcoin blockchain and its strategic bidding process could only be done because Yuga Labs is a “trusted party.”