First Mover Americas: Grayscale Bitcoin Trust at Issue in Court

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

The Grayscale Bitcoin Trust (GBTC) discount to the net asset value has fallen to its lowest level in a month ahead of oral arguments in federal court later Tuesday related to Grayscale Investments' lawsuit against the U.S. Securities and Exchange Commission. Grayscale is appealing the SEC’s decision to deny the conversion of the trust into an exchange-traded fund. Known in crypto markets as the "Grayscale discount," this key metric has narrowed to 42% at press time after hitting 47% in mid-February. According to data from TradeBlock, this is the trimmest discount since Feb. 7. “While far from a certainty, it is our view that the market is underpricing the likelihood of a Grayscale victory,” said Sean Farrell, vice president of digital-asset strategy at Fundstrat. Grayscale and CoinDesk are both owned by crypto conglomerate Digital Currency Group.

FTX sister company Alameda Research is suing crypto asset manager Grayscale Investments to seek injunctive relief for what it claims is over $250 million in asset value for the FTX debtor’s customers and creditors, according to a press release. The suit also asserts claims against Grayscale CEO Michael Sonnenshein, Grayscale owner Digital Currency Group and DCG CEO Barry Silbert. According to the complaint, Grayscale has extracted exorbitant management fees for its management of the Grayscale Bitcoin and Ethereum trusts and has allowed those trusts’ shares to trade at roughly a 50% discount to their net asset value.

White House press secretary Karine Jean-Pierre said the Biden administration is monitoring Silvergate Bank's (SI) situation, comparing it with those at other crypto companies and saying President Joe Biden has called on Congress to take action in this area. During her White House press briefing Monday, Jean-Pierre said she couldn't speak to Silvergate specifically, but noted that a number of crypto companies have "experience[d] significant issues" in recent weeks and pointed to statements from federal bank regulators warning of the risk cryptocurrencies could pose to banks and other financial institutions.

Chart of the Day

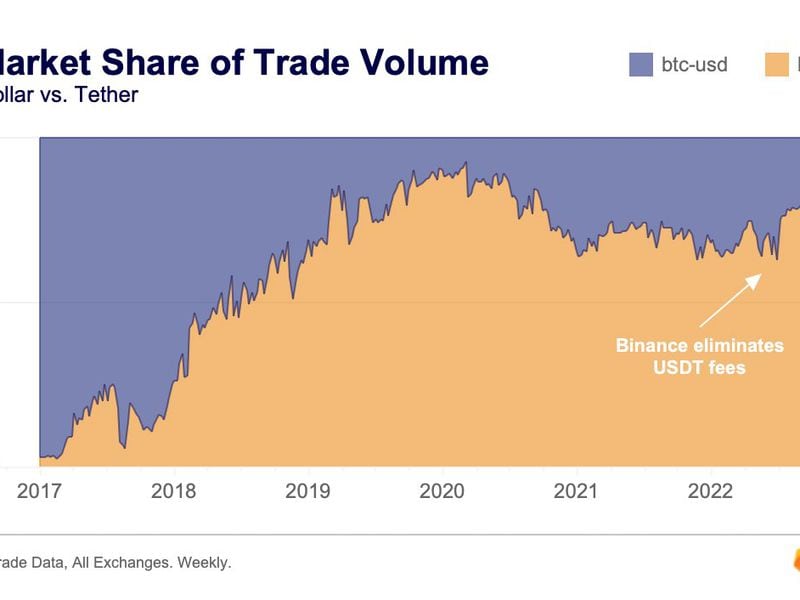

- The chart compares tether (USDT)-denominated bitcoin trading pairs' market share with U.S. dollar-denominated trading pairs since 2017.

- The share of tether-denominated trading pairs has increased sharply since the collapse of crypto exchange FTX in November and reached a record high last week.

- "With the death of SEN, stablecoins will likely become even more ubiquitous among traders. Rather than deposit your dollars with an exchange, you deposit them with a stablecoin issuer, receive stablecoins and then transfer those to an exchange," Paris-based Kaiko said in a note on Monday. SEN was an interbank transfer network that was run by Silvergate Bank and that was widely used by crypto traders. It was discontinued last week as Silvergate faces doubts about its ability to stay afloat.

- "The problem is, though, that stablecoin issuers still need access to a crypto bank, so the risk is now further concentrated," Kaiko added.