First Mover Americas: Ether Rising Ahead of Upgrade

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

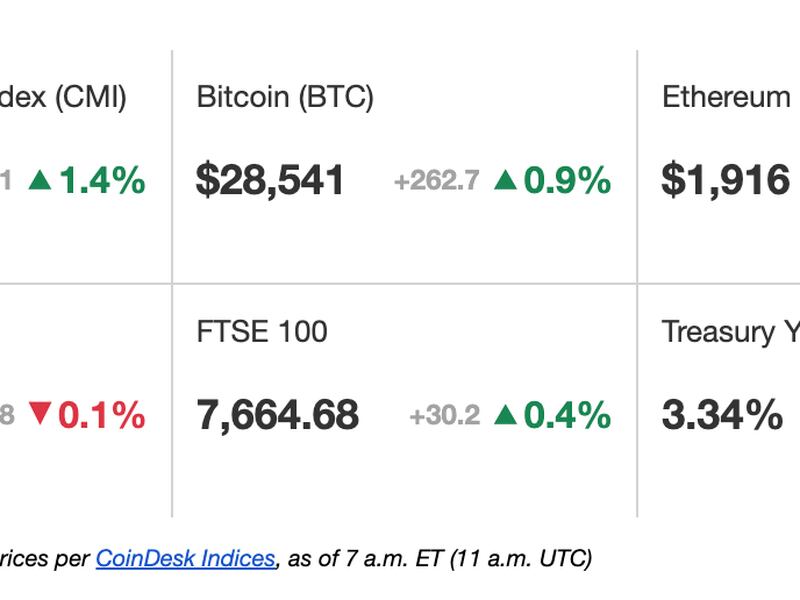

Latest Prices

Top Stories

Ether jumped to a nine-month high on Wednesday as an upcoming software upgrade on the Ethereum network is prompting investors and traders to funnel capital to ether and to other staking-focused tokens. Ether was up 5% to $1,920 in the past 24 hours, making it a top performer among major tokens. The token has reached its highest price since last August, CoinDesk data shows. The interest in ether comes ahead of Shapella, a portmanteau of Shanghai and Capella, two major Ethereum network upgrades that are expected to occur simultaneously on April 12.

PostFinance, Switzerland’s fifth-largest financial-services firm, says it will offer access to cryptocurrencies to its customers, thanks to a partnership with regulated digital-asset-services provider Sygnum Bank. PostFinance, which is owned by the Swiss government, will allow its 2.5 million customers to buy, store and sell bitcoin and ether, with more crypto tokens to be added in the future. Switzerland stands in contrast to the U.S., where stamping crypto out seems to be the end goal.

Paxful, a peer-to-peer bitcoin trading platform that's widely used in Africa, has suspended operations. But Paxful co-founder Ray Youssef is already trying to rally support for a new platform called Civilization Kit, or Civ Kit – a decentralized peer-to-peer bitcoin trading app built on Nostr, a decentralized social-media app that's backed by Twitter co-founder Jack Dorsey. A white paper for Civ Kit will be released in one or two weeks, according to Youssef, who added that he plans to rally the Bitcoin community to help build and fund the project. For now, Paxful is encouraging users to move funds to non-custodial wallets or other platforms like the newly created Noones peer-to-peer bitcoin marketplace.

Chart of the Day

- Ether's daily price chart shows the second-largest cryptocurrency has scaled the upper end of the expanding channel identified by colored trendlines and the 23.6% Fibonacci retracement of the November 2021-June 2022 sell-off.

- The breakout could bring outsized gains for ether, as chart analyst William Noble told CoinDesk early this year.

- "I saw formations like this in 2009 and 2010 when stocks rallied post-global financial crisis," Noble said.