First Mover Americas: DOGE Doubles in October, Coinbase Goes to Bat for Ripple

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

● CoinDesk Market Index (CMI): 1,033.77 +1.2%

● Bitcoin (BTC): $20,519.7 −1.01%

● Ether (ETH): $1,590.71 −1.86%

● S&P 500 Futures: 3,920.75 +1.0%

● FTSE 1000: 7,209 +1.6%

● Ten-year Treasury yield daily close: 4.08% +0.1

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.

Top Stories

Meme token dogecoin finished October with 17 times bitcoin’s gain for the month as DOGE supporter Elon Musk’s $44 billion Twitter deal drove speculation in the coin, whose price more than doubled during the month, rising 104%. Bitcoin rose 5.5%, and ether gained 18%.

Crypto exchange Coinbase has filed to support Ripple Labs against the U.S. Securities and Exchange Commission, which sued Ripple at the end of 2020 on allegations it sold XRP as an unregistered security. Coinbase joins a trade group and others in arguing the SEC's case threatens the broader industry.

India's central bank is introducing a pilot program for a central bank digital currency on Tuesday, and a retail version will start within a month. In a statement, the Reserve Bank of India said the use case for the wholesale digital rupee is the "settlement of secondary market transactions in government securities" because it would reduce transaction costs.

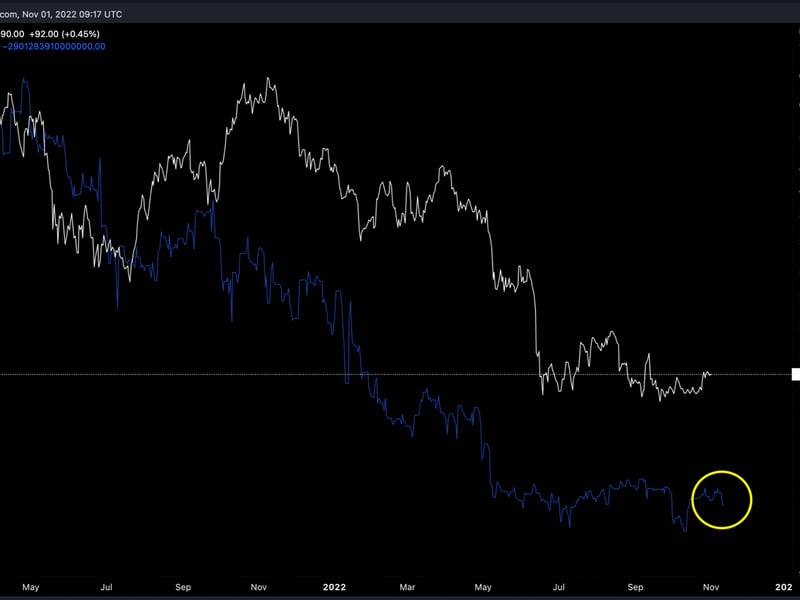

Chart of the Day

- The above chart provided by Decentral Park Capital portfolio manager Lewis Harland shows bitcoin has closely tracked the Federal Reserve's net U.S. dollar liquidity indicator since 2021.

- The dollar liquidity is again falling, a headwind for risky assets, including cryptocurrencies.

– Omkar Godbole