First Mover Americas: Crypto Markets Sinking on Silvergate

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin was down 5% early Friday, a day after a spout of negative developments surrounding crypto-friendly U.S. bank Silvergate Capital (SI). On Thursday, Coinbase (COIN), Circle, Paxos, Crypto.com, Bitstamp, Cboe Digital Markets, Galaxy Digital and Gemini all announced they will suspend Automated Clearing House transfers and other business operations with the bank. Silvergate's stock tumbled 58% to $5.72 on Thursday. The wider crypto market also lost ground with major altcoins taking a hit on Friday. Ether, the second-largest cryptocurrency by market capitalization, shed 5%, filecoin (FIL) lost 9%, aptos (APT) was down 8%, and litecoin (LTC) dropped 7%.

The crypto futures market also took a hit, with exchanges liquidating longs or bullish bitcoin futures worth over $62 million during Asian trading hours on Friday. That's the highest amount since August, according to data from Glassnode. Meanwhile, short liquidations totaled just over $500,000. Liquidation happens when the market moves against a trader's bullish or bearish bet, leaving him or her with insufficient funds to keep the leveraged trade open. The dominance of long liquidations shows the leverage was skewed on the bullish side, meaning most traders were positioned for a price rally.

FTX said $8.9 billion in customer funds are missing, according to a report from the Wall Street Journal, saying FTX identified that amount in customer funds that it can’t account for. On Thursday, FTX, a crypto exchange that filed for bankruptcy in November, said it had identified around $2.7 billion of customer assets, compared with $11.6 billion of balances outstanding on customer accounts.

Chart of the Day

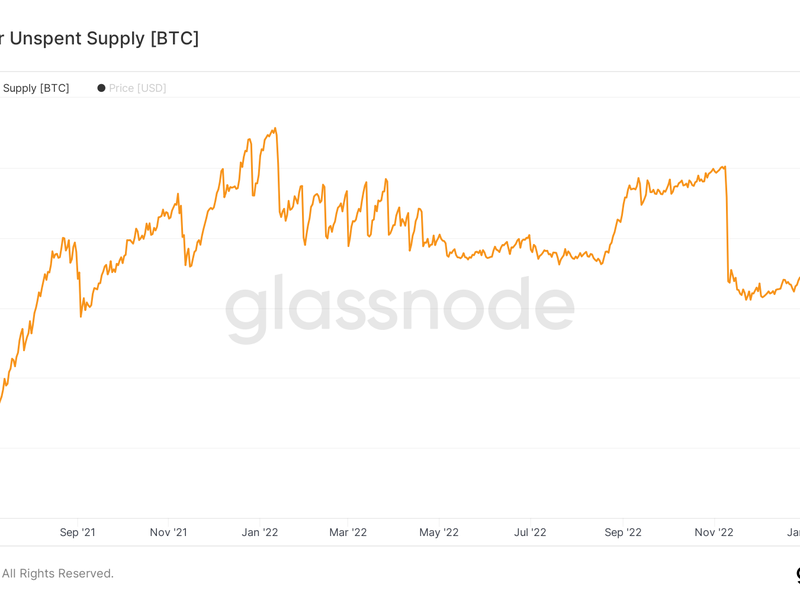

- The chart shows bitcoin miners unspent supply or the number of new coins held by miners rather than sold in the market

- The number has declined by 2,000 BTC to 1.8 million BTC, the lowest since July 2021.

- It's a sign of renewed selling by miners, or those responsible for minting new coins.