First Mover Americas: Bitcoin Clings to $28K as Turbulent Week Draws to Close

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

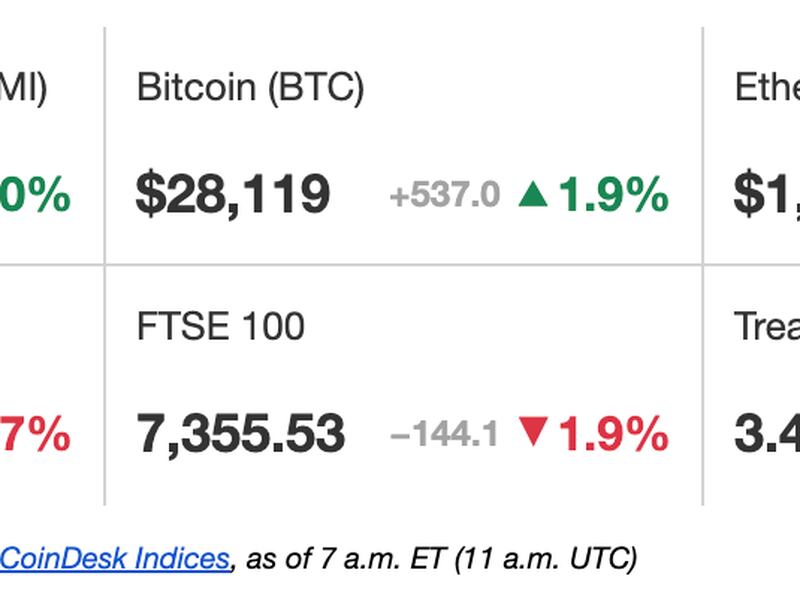

Latest Prices

Top Stories

After a week of adverse regulatory news and macroeconomic events, bitcoin has held fairly strong. The cryptocurrency is up 3% on the week and has managed to hold the $28,000 mark on Friday after reaching highs of $28,700 earlier in the week. Ether gained 2% on the day and reached $1,800 earlier in the week for the first time since August. The U.S. Securities and Exchange Commission on Thursday urged investors to exercise caution when investing in crypto assets and issued a Wells Notice to crypto exchange Coinbase earlier in the week. Coinbase's stock slumped as much as 20% in early trading Thursday following the news.

Federal prosecutors in New York charged Terraform Labs founder Do Kwon with fraud hours after he was arrested by police in Montenegro. "Montenegrin police have detained a person suspected of being one of the most wanted fugitives, South Korean citizen Do Kwon, co-founder and CEO of Singapore-based Terraform Labs," Montenegro's minister of interior, Filip Adzic, tweeted Thursday. Kwon has been the target of several investigations and was even on Interpol's red notice after stablecoin terraUSD (UST) and its $40 billion ecosystem imploded last year, sending shockwaves across the crypto markets.

Some Binance employees and trained "volunteers" are helping users in China and other countries evade Binance's Know Your Customer (KYC) controls, CNBC reported Wednesday, citing Chinese-language messages from a Binance-controlled Discord server and Telegram group. The message group participants, called "Angels," share techniques such as forging bank documents, falsifying addresses and hiding the country of origin to allow users to bypass controls and obtain a Binance debit card, according to the report. China banned crypto exchanges in 2017 and cryptocurrencies altogether in 2021.

Chart of the Day

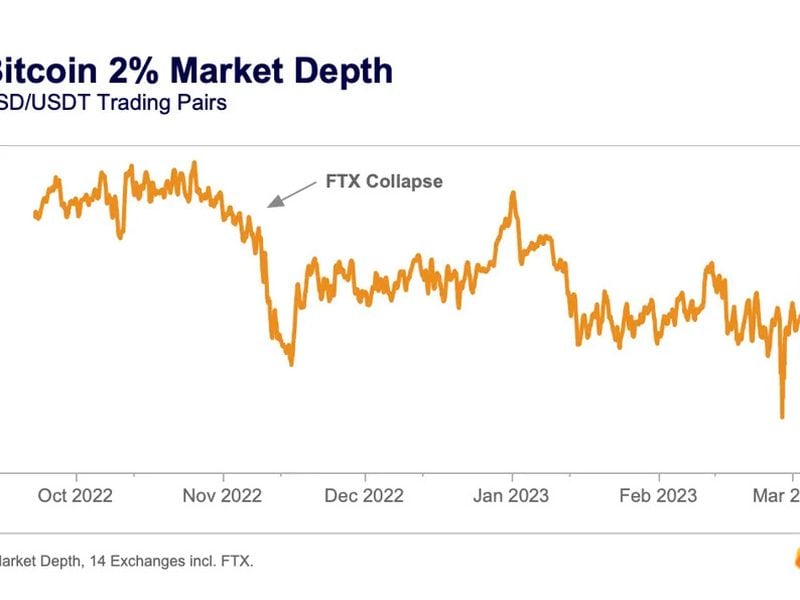

- The chart shows liquidity in the bitcoin market, as measured by a metric called the 2% market depth – a collection of buy and sell orders within 2% of the mid-price.

- The market depth has dropped to 10-month lows, indicating a tough time for traders looking to execute large buy and sell orders at stable prices.

- "The closure of Silvergate exchange network and wind-down of Signature bank's real-time crypto payment network, some of the only USD payment rails for crypto, resulted in U.S exchanges being harder hit from a liquidity standpoint as market makers in the region face unprecedented challenges to their operations," Connor Ryder, research analyst at Kaiko, wrote in a market update.