First Mover Americas: Bitcoin Battered as Markets Spiral

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk Market Index (CMI): 924 −8.9%

Bitcoin (BTC): $19,856 −8.2%

Ether (ETC): $1,392 −9.0%

S&P 500 futures: 3,916.25 −0.1%

FTSE 100: 7,751.62 −1.6%

Treasury Yield 10 Years: 3.92% −0.1

Top Stories

Investors sold stocks, especially shares of banks, and other risky assets ahead of the U.S. jobs report on Friday. Bitcoin has lost 9% over the last 24 hours, dropping below $20,000, a level the cryptocurrency hasn’t fallen below since mid-January. On Thursday, $250 million in long positions in bitcoin was liquidated, according to data from Coinglass. The wider crypto market also fell on Friday, after a week of interest-rate fears and the collapse of crypto-focused Silvergate Bank.

Crypto exchange Huobi has created a $100 million liquidity fund to protect against precipitous drops in its HT token, in response to the token suddenly falling 93% on Thursday. Justin Sun, founder of the Tron blockchain and a large HT holder, confirmed a transfer of $100 million. The rapid drop and then rebound was caused by "leveraged liquidation on the market caused by a few users," according to a tweet by Sun.

New York State Attorney General Letitia James sued KuCoin on Thursday, alleging the Seychelles-based crypto exchange is violating securities laws by offering tokens – including ether – that meet the definition of a security without registering with the attorney general’s office. The suit is the first time a regulator has claimed in court that ether is a security.

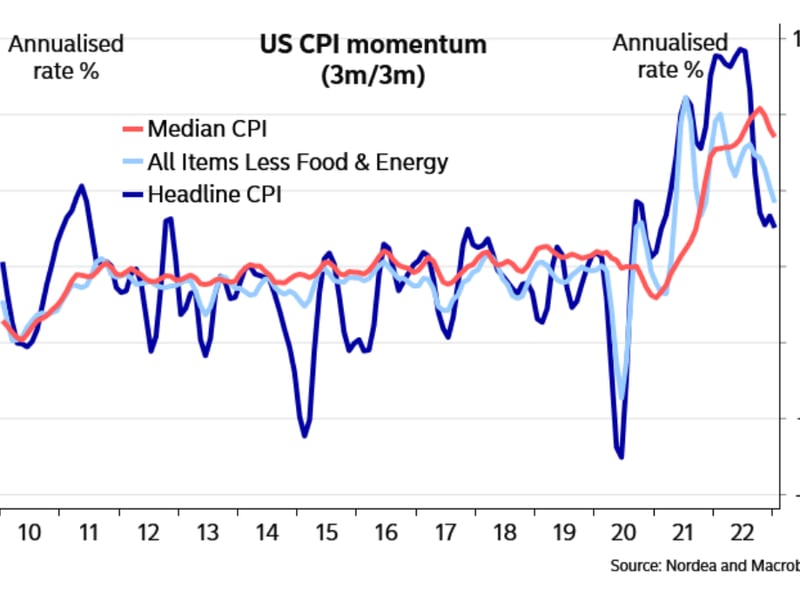

Chart of the Day

- The chart shows the momentum of most measures of the U.S. Consumer Price Index has weakened since August 2022.

- The market has recently raised its forecast for the peak Federal Reserve rate to 6.5%. A continued loss of inflation momentum would test those hawkish expectations, bringing relief to risky assets.

- The February CPI, which is scheduled to be released on Tuesday, is likely to show a 0.2% increase, translating into 6.2% annual growth.