First Mover Americas: Betting Against Bitcoin Was Popular Move Last Week

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Short-bitcoin funds saw inflows of $10 million last week compared with outflows of $12 million from long positions, according to crypto asset manager CoinShares, as upbeat U.S. economic data weakened investors’ appetite for risky assets. BTC fell below $23,000 on Saturday, its lowest point since Feb. 15. Short-bitcoin funds, which profit from a decline in the price of BTC, saw inflows last week while the price of bitcoin fell over 3% after it failed to consolidate above $25,000. "We believe this reaction reflects nervousness amongst U.S. investors prompted by the recent stronger-than-expected macro data releases, but also highlights its sensitivity to the regulatory crackdown in the U.S.," CoinShares said in a weekly report.

Liquid staking is the new second-largest crypto sector, overtaking decentralized lending and borrowing. Liquid staking is now a $14.1 billion sector based on the total value of assets that have been locked on blockchain networks by users in return for rewards. Decentralized lending and borrowing protocols have $13.7 billion locked, while decentralized exchanges remain the largest sector with $19.4 billion. The upcoming Shanghai software upgrade on the Ethereum blockchain is seen as the catalyst for the rise of liquid staking because it will enable stakers to withdraw the ether they have staked and accumulated rewards on for the first time.

Texas regulators have said the benefits to creditors from Binance.US’ proposed acquisition of bankrupt lender Voyager Digital may be negligible. A court filing Friday said the benefits hinge on whether Alameda Research is successful in recovering $446 million transferred to Voyager prior to its own bankruptcy. The court document also detailed concerns over Binance’s staking program, which it said appears to constitute an illegal securities offering. Alameda Research is a trading firm affiliated with collapsed crypto exchange FTX. It was also owned by FTX founder Sam Bankman-Fried.

Chart of the Day

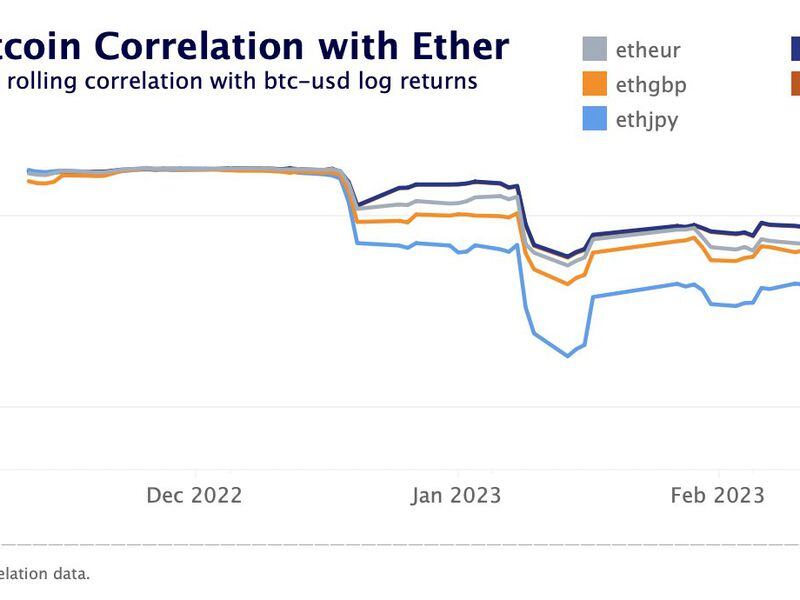

- The chart shows bitcoin's 30-day rolling correlation with Ethereum's native token ether, the second-largest cryptocurrency by market value.

- The correlation between the two has strengthened since mid-January, a sign of renewed focus on macroeconomic factors.

- Traders' appetite for risky assets has weakened, with U.S. Treasury yields rising in response to rates. Traders are pricing three more 25 basis point rate hikes from the Federal Reserve in March, May and June.

- Omkar Godbole