Cryptocurrencies Trade in Sync After FTX Collapse – Just Not With Stocks

They say that all correlations go to one during a financial crisis.

What's noteworthy about the most recent crash in crypto markets – triggered by the collapse of Sam Bankman-Fried's FTX exchange and his trading firm Alameda Research – is just how divergent the narrative was from traditional markets. That's noteworthy, since bitcoin (BTC), the largest cryptocurrency, was largely trading in sync with U.S. stocks as recently as September.

The market contagion from FTX spread rapidly in crypto, sending the 162-asset CoinDesk Market Index (CMI) down about 18% so far in November.

And despite widespread headlines about the FTX-inflicted turmoil across traditional financial media, U.S. stocks were mostly unfazed – trading higher based on softer-than-expected inflation readings that inspired investor hopes of a less threatening monetary-tightening campaign by the Federal Reserve.

The Standard & Poor's 500 Index is up 3.1% on the month.

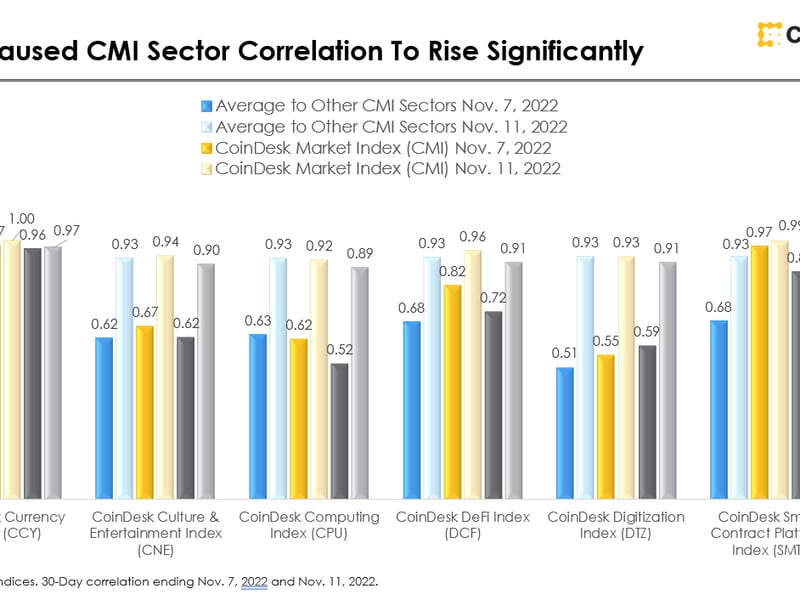

An analysis of CMI and its six sector indexes shows how correlations surged among the various digital assets from Nov. 7 to Nov. 11.

The crypto market went into "a highly correlated state after the FTX collapse," said Jodie Gunzberg, managing director of CoinDesk Indices. "The event was (and still probably is) so powerful that it is driving the entire asset class together."