Crypto Market February Roundup: Bitcoin Layer 2 Protocol Stacks, Ethereum Staking Derivative Tokens Surge

January euphoria in crypto markets turned to February worry as investors sent prices of most, major digital assets down.

The retreat coincided with a cascade of concerning inflation and jobs data, starting with a lukewarm Consumer Price Index (CPI) in the first half of the month and continuing with an alarming steadiness in jobless claims and an even more alarming rise in consumer spending. It also came amid a flurry of regulatory action in the U.S. that raised concerns about government agencies overreaching or misdirecting their efforts.

Bitcoin (BTC) was recently trading flat from a month ago at about $23,080, although it was well down from its mid-February highs above $25,000 mark, according to CoinDesk data. The largest cryptocurrency by market capitalization rose about 40% in January.

Ether (ETH), the second-largest crypto by market value, also traded sideways for the month to hover just over $1,600. ETH rose more than 30% in January.

With Ethereum’s upcoming Shanghai upgrade, markets’ interest in liquid staking derivatives soared, with LDO, the governance token of the decentralized autonomous organization behind liquid staking provider Lido surging 33% for the month. Its rival Rocket Pool’s native RPL token rose 18%.

“I think the narrative of ETH withdrawals and the Shanghai update that's coming made a lot of people worry that those wouldn't perform as well,” Katie Talati, head of research at crypto asset-management firm Arca, told CoinDesk. “But a lot of people have accrued revenue in fees that they've earned over this staking period.”

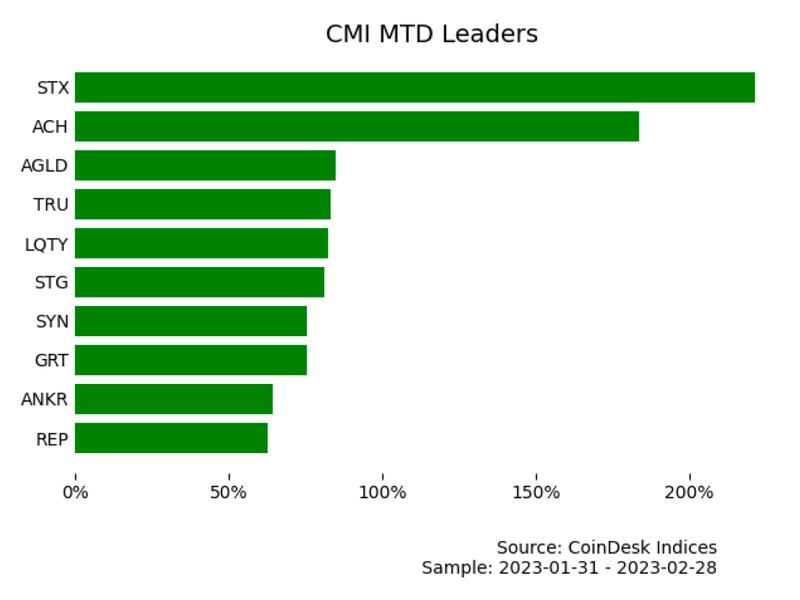

Winners

Bitcoin layer 2 protocol Stacks Network’s native STX token grabbed the biggest winner trophy among 160 assets in the CoinDesk Market Index, soaring 216% in February. The STX token started off the month hovering around 27 cents and climbed as high as 95 cents on Feb. 27 before retreating slightly.

The STX price surge coincided with market participants' growing interest in creating Ordinal non-fungible tokens (NFTs), which are NFTs on bitcoin enabled by so-called inscriptions on Bitcoin’s mainnet.

Arca’s Talati said that the broader idea of improving the Bitcoin network’s scalability has been around since Bitcoin’s Taproot upgrade – multiple signatures and transactions batched together for better privacy and scalability – in November 2021.

But she added: “More information has become available in the last few weeks in people buying and trading them more. A lot of people have been saying, ‘Well, if Ordinals do really well, this gives a reason for people to use the Bitcoin network, and therefore they'll have the need to use Stacks.'”

Talati noted that there’s still no marketplace or infrastructure for Bitcoin NFTs yet. “People are trading these Ordinals via over-the-counter (OTC) using spreadsheets for bids and asks.” she said.

Payment gateway Alchemy Pay (ACH) in the Currency sector was February’s second-largest winner, rising nearly $170%. Adventure Gold (AGLD) and TrueFi (TRU) jumped more than 50% during the month, according to CoinDesk Indices. The CoinDesk Market Index (CMI) is up 3.3% for the month.

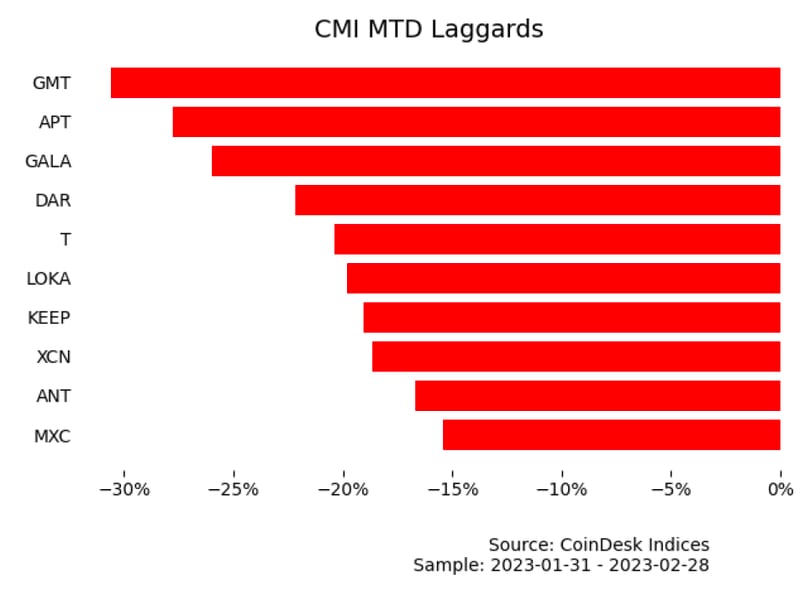

Losers

Gaming- and metaverse-affiliated tokens, which led January’s winner board, were among February’s biggest laggards. GMT, the native token of the STEPN ecosystem in the Culture and Entertainment sector, dipped 33% this month, while Gala Games' native GALA token, which surged 233% last month, dropped 28% in February.

Layer 1 network Aptos’ APT token, which surged 387% in January, dropped nearly 30% in February.

Vetle Lunde, senior analyst at crypto research firm Arcane Research, wrote in a weekly note that the recent ups and downs of tokens, saying that in three out of the last four weeks, the 'top 50 coin' winner of the previous week has become the next week’s worst performer.

“Altcoin cycles tend to be short-lived, but this is beyond the norm and has all the hallmarks of a bored market chasing opportunities, in addition to no new capital inflows,” he wrote, adding: “Poor liquidity facilitates this erratic pattern, and you do not want to be the one holding the bag when the music ends.”