Crypto Analysts Warn Against Shorting DYDX Ahead of $200M Token Unlock

Perpetuals-focused decentralized exchange dYdx is set to unlock 150 million or about $200 million worth of its native token DYDX on on Feb. 2, which could be a potential shorting opportunity for traders. However, the supply release is not necessarily bearish, some analysts said, cautioning against taking short bets in the derivative market tied to the cryptocurrency.

"While the upcoming token unlocks will give venture capitalists who invested in the project access to part of their token allocation, the market feels they will more likely hold instead of sell, continuing to show support for DYDX and signaling their commitment to the community that they are here for the long term," said Charles Storry, head of growth at Phuture, a crypto index platform.

Token unlocks refer to the process of releasing tokens blocked under the terms of the project's funding rounds or fundraising efforts. Per Coingecko, the supply of DYDX will be fully unlocked by Sept. 2026.

Activity in decentralized exchanges like dYdX and GMX, offering perpetual futures, has picked up pace since the collapse of centralized derivatives giant FTX. Trading volume on dYdX increased to $2.9 billion on Jan. 14, according to data from Nomics, after reaching lows of $212 million after FTX’s unfolding. Perpetuals are futures contracts, but unlike the latter, they don't have an expiry date. That allows traders, both bulls and bears, to hold their long/short positions as long as they like.

“DeFi investors see perpetual contracts growing in popularity and feel that the market will favor companies in the space,” Storry added.

Move from CeFi to DeFi?

The shift from centralized to decentralized derivatives exchanges is likely to gather speed this year, amid collapse of some of the centralized exchanges such as FTX.

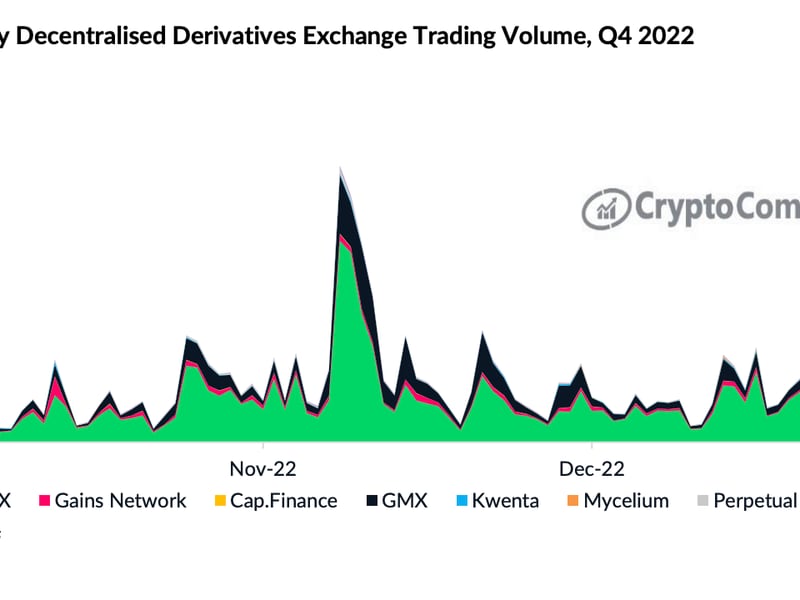

“Decentralized derivatives and perpetual exchanges are another area in DeFi that is poised for growth this year,” CryptoCompare said in its 2023 outlook.

“The rise of GMX has been fascinating to watch in the second half of 2022. Since then, several newer derivatives exchanges have launched including Gains Network, and Perpetual Protocol, and will be competing with GMX to take the throne off dYdX, which is currently the largest decentralized derivatives exchange. These exchanges have seen an increase in user base since the collapse of FTX,” CryptoCompare added.

Overcrowded trade

Miles Deutscher, trader and analyst, said in a tweet that, ahead of the dYdX unlock, it’s better to be net long than short. Firstly, because shorting is becoming a “crowded trade.”

A crowded trade is a popular position – bullish or bearish – based on a theme favored by a large number of investors. Such extreme positioning almost always presages trend reversals.

However, “This is a dangerous move in a market where there’s a lot of upward momentum,” David Scheuermann, a trader, Crypto Finance AG said, referring to the widespread shorting of tokens ahead of the unlock.

“Teams of projects are not oblivious to the impact large token unlocks can have on the price of their coin. They can’t stop investors from selling, but they may choose to release good news around the unlock to increase buying,” Scheuermann noted.

The wider crypto market has also seen an uptick over the last month, following the downfall in prices after crypto exchange FTX collapsed. Bitcoin has gained 25% over the last month, pushing its market cap up to $404 billion. Bitcoin’s market cap dipped to $319 billion following the collapse of FTX.

Over the last month, the DYDX token has been trading in a range between $1.12- $1.58. At press time, the token was around $1.40, per CoinDesk data.

“I think the considerable uptick in price has definitely been driven by some of the more recent upward moves in the major tokens,” said Christopher Newhouse, a crypto derivatives trader at GSR.

Scheuermann voiced a similar opinion, saying the positive price action across the market has flushed out shorts initiated in December.

"On January 9, when DYDX was trading at $1.32, more than $1m worth of DYDX short positions were liquidated, pushing the price even higher. Open Interest has come down significantly since the end of December/beginning of January.

Read more: Short Traders Suffer $200M in Losses as Ether, Cardano Lead Crypto Majors' Gains