Bitcoin Trades at Nearly $650 Premium on Binance.US

The gap between bitcoin's price in U.S. dollars (BTC/USD) on prominent digital assets exchanges like Binance and Coinbase and the price on Binance's U.S. arm has widened sharply this month, causing unease among crypto commentators on Twitter.

At 09:26 UTC Tuesday, the BTC/USD pair listed on Binance.US traded at a nearly $650 premium to its Coinbase-listed counterpart and to Binance's bitcoin-tether pair (BTC/USDT) – a significant rise from the premium of around $20 seen at the end of April, data from charting platform TradingView show.

According to pseudonymous Twitter-based analyst @fewseethis, the premium on Binance.US likely results from market makers leaving the exchange in anticipation of regulatory action. Market makers are entities tasked with providing liquidity to the order book.

In February, Binance.US came under the radar of the U.S. Securities and Exchange Commission (SEC) over trading affiliates. One agency official in March said Binance.US was operating an unregistered securities exchange in the U.S.

"IF there is some sort of gov action against Binance.US incoming AND market makers who usually do business there know about it, THEN it's possible they left and there isn't enough liquidity & possibilities for arbitraging are diminished," @fewseethis tweeted.

Binance.US' order book was skewed in favor of bids – buy orders – at press time, according to data from Cryptowatch. That's a sign of weak market depth and an exodus of market makers, according to Griffin Ardern, a volatility trader from crypto asset management firm Blofin.

The chart shows the 2.5% market depth on Binance.US, a collection of pending buy and sell orders within 2.5% of the mid-price. The mid-price is the average of the bid and the ask/offer prices. The green line, representing the number of pending buy orders, is higher than the red line, which shows the sell orders.

"When the liquidity is sufficient, the depth of buy & sell sides is usually constantly changing, but a dynamic balance is maintained. On Binance.US, the order book is imbalanced with significantly more buy orders than sell orders," Ardern told CoinDesk. "For a giant exchange, such a depth chart is undoubtedly abnormal. Prime market makers are leaving Binance.US, possibly due to regulatory pressure and renewed compliance requirements."

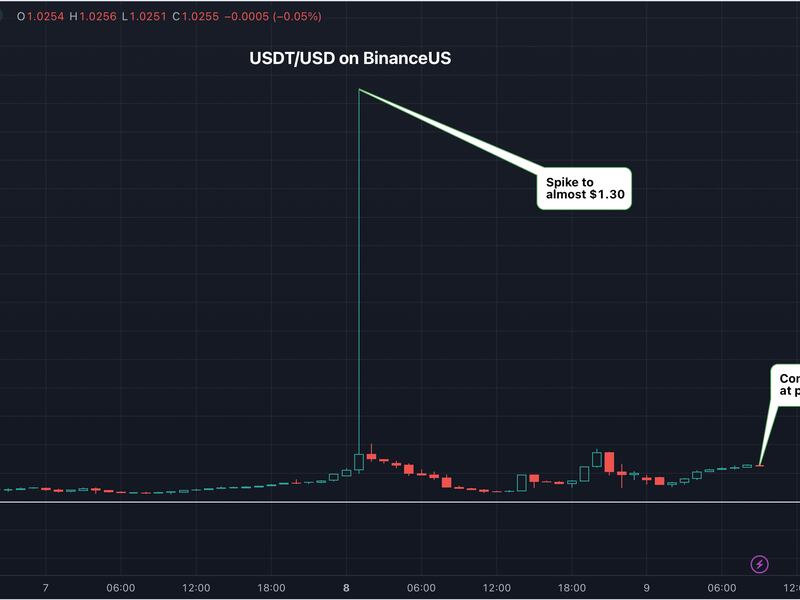

Moreover, on Monday, tether, the world's largest stablecoin, surged to $1.3 on Binance.US, deviating from its dollar peg. The stablecoin, which is meant to trade in line with the greenback, continued to be priced at a premium early Tuesday.

The reason for tether's appreciation is unclear. Some in the crypto community have held USDT/USD's surge responsible for Binance.US' BTC/USD pair trading at a premium relative to tether-denominated pairs.

In contrast, others, including popular pseudonymous trader Byzantine General and crypto exchange OPNX's market maker Alice, said the premium signifies fiat withdrawal issues at the exchange.

CoinDesk reached out to Binance.US seeking clarification on the matter and was awaiting a response at press time.

"This USDT premium should be irrelevant if FIAT withdrawals work properly," Byzantine General tweeted, asking, "Can't people just withdraw from Binance.US." Alice voiced a similar opinion saying, " It has to be (at some threshold) either a secret USD fee or USD withdrawals not working."

illiquid + hard to get usd off. gotta convert to USDT or USDC and the premiums for both on there are insane so buying crypto just to withdraw is happening i think.

— b.biddles (@thalamu_) May 8, 2023