Bitcoin Falls Slightly After Fed Rate Hike

Bitcoin’s (BTC) price dropped slightly to below $28,500 after the U.S. central bank did what was widely expected and raised interest rates by 25 basis points (bps). The increase sends the Federal funds rate to a target range of between 5% and 5.25%.

The largest cryptocurrency by market capitalization was recently trading at around $28,350, down about a percentage point over the past 24 hours, according to CoinDesk data.

The Fed's decision on Wednesday marked the 10th rate hike in 14 months. In its statement accompanying the rate hike, the Fed's Federal Open Market Committee (FOMC) said “tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation,” and that it would keep close attention to inflation risks.

In a press conference following the rate announcement, Fed Chair Jerome Powell said that although prices had “moderated somewhat since the middle of last year… inflation pressures continue to run high and that the process of getting inflation back down to 2% has a long way to go.”

Powell also said that the decision on the rate hike pause “was not made today,” though he noted that the current statement did not signal additional rate hikes as had previous statements. “The assessment of the extent to which additional policy firming may be appropriate is going to be an ongoing one, meeting by meeting," he said, noting uncertainties in credit conditions.

“It's possible we'll have what I hope will be a mild recession,” Powell added.

The CME FedWatch Tool showed that currently over 93% of traders see the Fed pausing its diet of rate hikes at the June policy meeting.

Ether (ETH), the second-largest cryptocurrency by market capitalization, recently rose roughly 0.3% to hover at around $1,878. The CoinDesk Market Index (CMI), which measures the overall crypto market performance, was down 1% for the day.

In an email to CoinDesk, Michael Safai, managing partner of crypto trading firm Dexterity Capital, said that the latest Fed decision would likely lead to “mixed outcomes” for crypto traders. “While the language on future rate hikes was softened, the Fed left the door open by saying that future decisions will be macro data dependent. Inflation data is improving, but it still isn’t rosy enough to excite crypto traders,” Safai said in an emailed comment.

“Crypto is quiet right now, which means that there isn’t enough exit velocity for the top 10 coins to break out of the macro correlation,” he added. ”Bitcoin and Ethereum are more likely to be range-bound until we see some clue as to where inflation is going. The markets could be in for a bit of a slow summer if the economic recovery follows a measured pace.”

Greg Magadini, director of derivatives at crypto analytics firm Amberdata, pointed out in an email prior to the Fed’s decision that there will be two Consumer Price Index (CPI) inflation readings before the Fed's next meeting in mid-June, meaning the possibility of a hike remains on the table.

Magadini said BTC has been driven by macro events this year with Wednesday’s rate hike priced in already.

Equity markets closed down on Wednesday, with the S&P 500 edging down 0.7%. The Dow Jones Industrial Average (DJIA) and the tech-heavy Nasdaq Composite were down 0.8% and 0.4%, respectively.

In bond markets, the note on the 2-year Treasury yield recently dropped 12 basis points to sit at 3.86%, while the note on the 10-year Treasury yield fell 7 basis points to 3.35%.

Crypto investors have been struggling to understand the potential impact of recent bank failures and crypto regulatory feuding on markets.

“Bitcoin still remains anchored, unlikely to rally above the $30,000 level until the US gets some regulatory clarity,” Edward Moya, senior market analyst at foreign-exchange market maker Oanda, wrote in a Wednesday note.

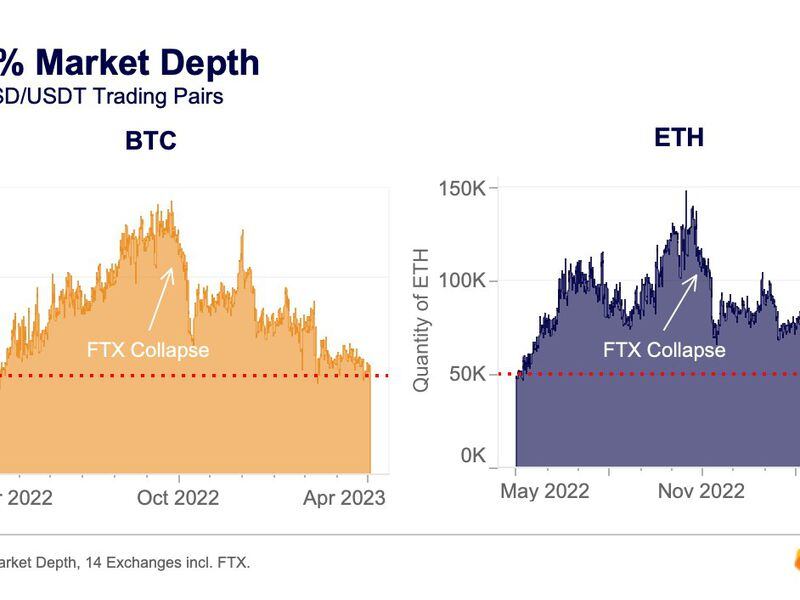

Meanwhile, crypto data firm Kaiko’s chart showed that BTC and ETH’s 2% market depth, a metric for assessing liquidity conditions, has approached near one-year lows.

Dessislava Ianeva, research analyst at Kaiko, noted to CoinDesk that despite bitcoin’s more than 70% price gains this year, trade volume on centralized exchanges is lower than last year for the same period. She suggested that the low volume stemmed partly from “greater macro and regulatory uncertainty.”

“Market makers are still cautious about adding liquidity and have likely revised their risk management strategies," Ianeva said, adding that the liquidity gap that emerged after the collapse of exchange FTX and its trading arm, Alameda Research last November, is “proving persistent.”

“Liquidity will hopefully return in time, and critical mass will build in newer areas of the digital asset space, but until that happens – or a major headline reinforces or challenges crypto’s appeal – Bitcoin will keep tracking the broader markets,” Dexterity Capital’s Safai said.