Only 31% of Staked Ether May be Profitable: Binance Research

Analysis by Binance Research has found that a notable minority of ether holders who staked their ETH in Ethereum's Beacon Chain over the past three years are making money, while the rest are underwater.

Ethereum staking involves users locking their ETH tokens to validate transactions in return for a reward paid out in ether. Staking, therefore, is referred to as passive investing – putting coins lying dormant in self-custody or in an exchange wallet to use. Currently, onchain annualized staking yields are around 4%.

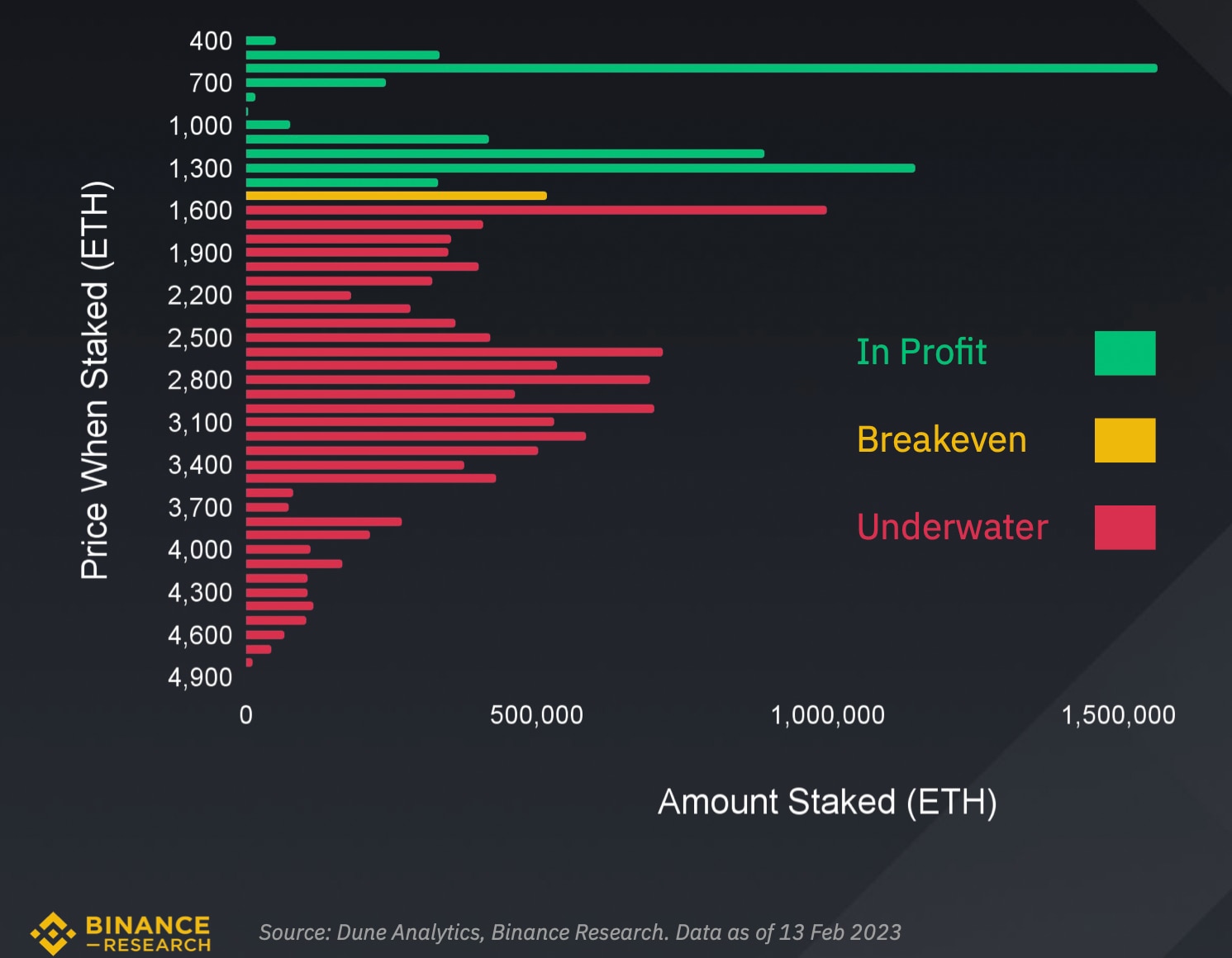

More than 16.5 million ether, worth $27.7 billion, has been staked since Beacon Chain went live in December 2020, of which 31% or 5.115 million ETH are in profit while the rest, 11.385 million ETH, are in loss, according to Binance Research.

The loss here means ether's current going market rate is less than the rate prevalent when they were locked in the Beacon chain.

The analysis comes at a time the market is trying to gauge potential selling pressure following Ethereum's Shanghai upgrade, scheduled for mid-March. The highly anticipated upgrade is set to open withdrawals of staked ETH.

Per Binance Research, those underwater have little incentive to liquidate their holdings after the Shanghai upgrade. Meanwhile, those in profit are likely to keep holding.

"We note a sizeable amount of ETH (around 2M) was staked at prices in the US$400 - 700 range – this represents the earliest stakers in Dec 2020 – a group that is likely illiquid given that liquid staking was far less known at the time," Binance Research noted in the report published early Thursday.

"While this is a considerable chunk of staked ETH and is currently at profit, given these were the earliest stakers in the market, we can imagine these are some of the strongest Ethereum believers," Binance Research said.

Note that the whole staking balance cannot be withdrawn on the day of the upgrade. Besides, only 43,200 ETH can be unstaked per day. However, the total staking reward earned, which comes to around 1 million ETH, can be withdrawn instantly, according to Saxo Bank.