Crypto Observers Maintain Risk On Bias as US Debt Ceiling Nears

Last week, U.S. Treasury Secretary Janet Yellen warned that the government would reach its statutory debt limit of $31.4 trillion on Jan. 19.

Understandably, that's scary and might force crypto investors to reconsider the sustainability of bitcoin's (BTC) recent rally. After all, we are talking about the government of the world's largest economy with the deepest financial markets and one that controls the supply of the global reserve currency, the greenback, reaching the limit on how much it can borrow to fund its operations.

Still, it's no time to panic, as the shutdown won't happen immediately. Yellen has promised to implement "extraordinary measures" to help the government meet its obligations for at least five months, buying a few months for Congress to end the deadlock and increase the so-called debt ceiling to avoid a shutdown.

And these measures could bode well for risk assets, including cryptocurrencies, according to analysts.

Debt ceiling and crypto

"Treasury Secretary Janet Yellen has said that her institution would implement 'extraordinary measures' to extend the time available to reach an agreement before a shutdown is necessary. This will obviously include a limit to the new debt that can be issued, which will reduce the supply of U.S. treasuries and – all else being equal – push up the prices and lower the yields. Lower yields imply an easier monetary environment, which is good for risk assets," Noelle Acheson, author of the popular "Crypto Is Macro Now" newsletter, told CoinDesk.

Bond yields represent borrowing costs in the economy and investors' risk appetite is closely tied to the availability of cheap credit. The lower the yields, the stronger the risk appetite and vice versa.

Since early 2020, stocks, cryptocurrencies and other risky assets have moved largely in the opposite direction of yields on the U.S. Treasuries (government bonds). Bitcoin, the leading cryptocurrency by market value, fell over 60% last year as Federal Reserve's (Fed) rapid rate hikes lifted the 10-year Treasury yield by 153 basis points to 3.88%.

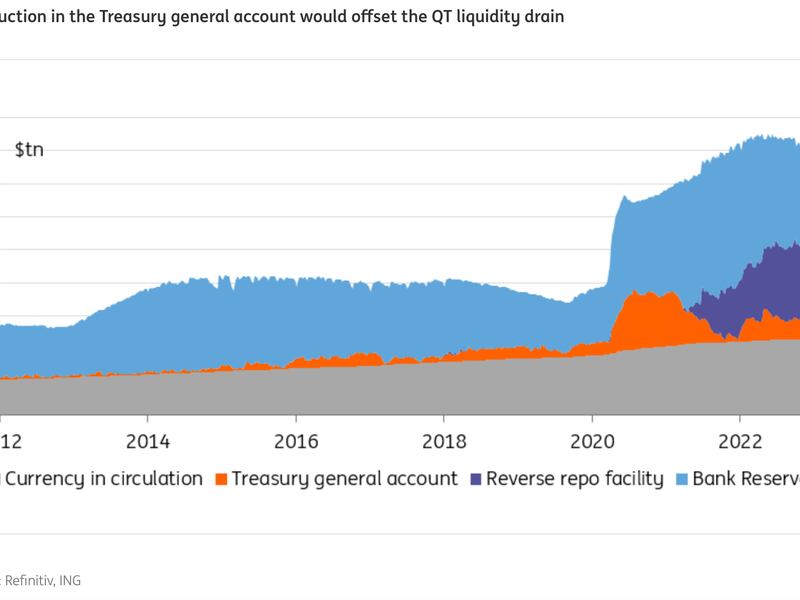

Phillip Gillespie, ex-CEO of crypto liquidity provider B2C2 and partner at AWR, a multi-asset HFT based in London, said, "The Treasury General Account (TGA) has $400 billion still in it, so treasury could use that cash to offset the deadlock in the debt ceiling. Some view this as countering Fed's efforts to tighten financial conditions."

The Treasury General Account (TGA) is the government's operating account maintained at the Fed to collect tax revenue, customs duties, proceeds from the sale of securities, public debt receipts and meet government payments.

The TGA is a liability on the Fed's balance sheet and must be matched by assets. When the Treasury makes payments, the cash is withdrawn from the TGA and sent to bank accounts of individuals and businesses. That, in turn, increases the reserves available with commercial banks, potentially boosting lending and leading to monetary easing in the wider markets/economy.

"We live in a two-tiered monetary system where entities (mostly commercial banks) who have accounts at the Fed pay each other in special money called central bank reserves, and everyone else transacts in bank deposits. When the TGA decreases, those reserves go into the commercial banking system, and increase the banking system’s reserve assets and bank deposit liabilities," Fed watcher Joseph Wang said in an explainer.

Assuming the treasury runs down the TGA as expected, it could inject liquidity into the system and compensate, at least to some extent, for the Fed's ongoing quantitive tightening (QT), a balance sheet normalization process, and a way of sucking out liquidity from the system, that has roiled risk assets since June 2022.

"The resulting injection in liquidity in the system, all else being equal, could go some way toward dampening the liquidity draining impact of quantitive easing," analysts at ING said in a report dated Jan. 11. "This, in turn, would be another supportive development for Treasuries [and suppress yields]."

Contentious negotiations

The U.S. debt ceiling issue is not new. According to the U.S. Treasury, "since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents."

This time, however, the consensus is that the looming debt battle might be the most intense since 2011, which spooked investors and prompted Standard and Poor's to downgrade the U.S. sovereign rating from AAA (outstanding) to AA+ (excellent).

"The debt ceiling never used to be an issue and was always raised without much fight. But then, in 2011, it became a huge issue and the economy took a hit that lasted for a few months, and the Federal credit rating was downgraded. While most politicians should remember that time, or at least understand their recent history, this time might also be different because this group of House Republicans is clearly looking to shake things up," Wes Hansen, director of trading and operations at crypto fund Arca, said in an email.

Per CNN, House Speaker McCarthy recently told President Joe Biden that Republicans are interested in imposing a spending cap in exchange for temporarily raising the debt ceiling. Biden, however, ruled out negotiations, saying, "It's not and should not be a political football. This is not political gamesmanship."

There are signs of stress in some lesser-tracked coroners of traditional markets. "The price of 5-year U.S. credit default swaps, currently at their highest monthly average since the tail end of the 2011 debt limit crisis which led to an S&P downgrade of the US rating," Acheson said. "Markets are more nervous this time than in previous stalemates."

The nervousness may spread to other corners of the market should the deadlock persist for long, resulting in outflows from cryptocurrencies.

"If we get to the point that the US might default, or the world believes there is a chance we might default, it will be bad. The traditional markets will throw a fit at some point in the next couple of weeks if a deal isn't done. If risk assets really sell off, that will certainly affect digital assets," Hansen said.

Richard Rosenblum, co-founder of crypto trading firm and liquidity provider GSR, voiced a similar opinion, adding that "the probability that sanity does not eventually prevail and the U.S. defaults still stands near zero."

Therefore, the risk aversion could be short-lived. Moreover, the market instability could pull forward the much-anticipated Fed easing, as Bank of America's rates research team said in a note to clients on Jan. 13.