Sam Bankman-Fried's Crumbling FTX Empire Holds $1.2B Cash Reserves

The various divisions of Sam Bankman-Fried's crumbling set of companies have $1.2 billion in cash as of Nov. 20, far below the $3.1 billion it owes its top 50 creditors, court documents show.

About $751 million of that is held in debtor entities and the rest, $488 million, is in non-debtor entities, according to the document, filed on Monday by FTX's proposed financial advisor, Alvarez & Marsal North America. About $514 million is unrestricted cash, $260 million is custodial and $465 million is restricted cash, which is earmarked for specific purposes like loan repayments and can't be use for general business purposes.

Crypto exchange FTX fell from grace over the past couple of weeks after CoinDesk's revelation that a big chunk of sister company Alameda Research's assets were the crypto exchange's tokens. The exchange filed for Chapter 11 bankruptcy in U.S. courts on Nov. 11 in chaotic fashion, mislabeling that some companies under the FTX umbrella were also filing for bankruptcy protection. It may have more than 1 million creditors, and owes the 50 largest about $3.1 billion, according to another court filing.

Alameda Research has the largest reserve of cash out of the various entities at $393 million, while FTX Japan has the largest reserve of cash at $171 million of firms under the FTX silo. The Japanese crypto exchange has reportedly said it is preparing to restart withdrawals by the end of the year.

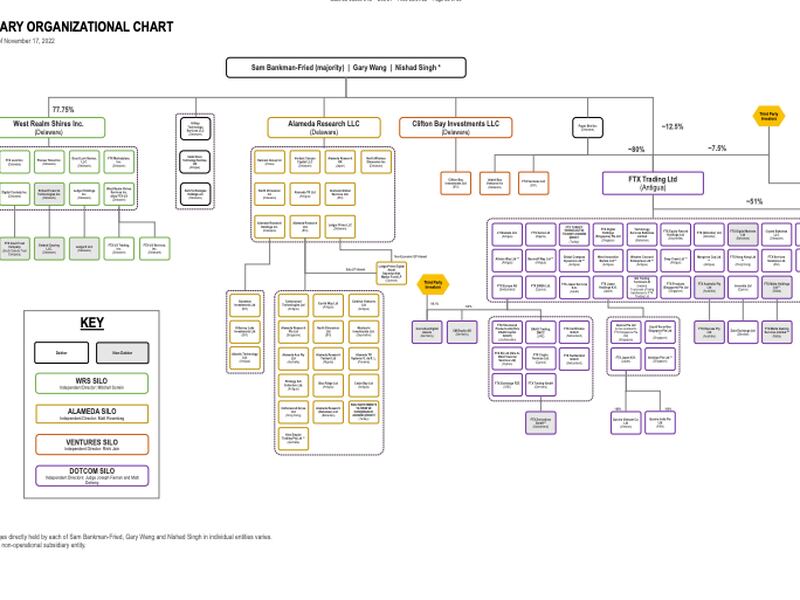

Another filing showed the complicated corporate structure of SBF's 100 or so companies, most of which he was a majority owner of. The parent company of FTX was in Antigua, according to the document, not the crypto exchange's stated headquarters location of the Bahamas.

The disgraced exchange has also been criticized by its new CEO John J. Ray III, who has previously supervised financial scandals such as Enron. Ray called out the poor record-keeping and the lack of experience among senior managers, as well as the use of company funds to purchase real estate in the Bahamas.

Read more: Pension Giant Ontario Teachers' Plans to Write Off All $95 Million Invested in Crypto Exchange FTX

UPDATE (Nov. 22, 06:55 UTC): Adds additional background, updates embedded image.